Should You Buy Gold?

| |||

Understanding the Recent Gold Rally and Currency ConcernsOctober 22, 2025 | |||

Gold has surged more than 60% this year, surpassing $4,300 per ounce, alongside new highs in numerous other asset classes. This remarkable rally has generated significant media attention and left many investors questioning whether this episode differs from previous gold market cycles.

Some refer to this phenomenon as the "debasement trade," rooted in the notion that governments face pressure to diminish currency strength via deficit spending and loose monetary policy. Combined with dollar weakness, these factors have drawn certain investors toward assets like gold, perceived as a "store of value," particularly as equity market volatility has resurged.

Although fiscal deficit concerns carry merit, historical evidence demonstrates that forecasting gold price movements remains challenging, and numerous drivers beyond currencies and interest rates are propelling broader market gains. For investors with long-term horizons, the question is not whether to choose between stocks and bonds versus gold, but rather determining appropriate allocations across these asset classes within a diversified portfolio.

Most critically, distinguishing between short-term trading activity and long-term financial priorities such as generating income and achieving growth becomes essential, particularly after an asset has already experienced substantial appreciation.

Currency debasement through history

Although currency debasement as a concept dates back millennia, it remains a recurring worry that emerges periodically. The traditional meaning of "debasement" describes governments diminishing precious metal content in coinage. Historically, this practice enabled governments to produce additional coins from identical quantities of precious metal, yet simultaneously reduced each coin's purchasing power.

Today, most currencies operate as "fiat currencies," deriving value from confidence in their issuing governments rather than precious metal backing. Contemporary debasement concerns therefore focus on whether governments will tolerate elevated inflation and currency depreciation, as this would ease the management of outstanding debt obligations.

This connects to other concepts that became prominent following the 2008 financial crisis. Economists Reinhart and Rogoff documented what they termed "financial repression" - strategies maintaining artificially suppressed interest rates to diminish the real burden of government debt. This approach disadvantages savers whose cash holdings lose value when interest rates lag behind inflation. Given continued national debt expansion, investor anxiety about such policies and the resulting search for value-preserving assets is understandable.

Despite these longer-term concerns, current evidence regarding whether this is happening today remains mixed. First, inflation readings have proven persistent but not extreme. The Consumer Price Index, Personal Consumption Expenditures Index, and Producer Price Index all register at 3% or below. Second, bond markets are not signaling expectations of high inflation. The 10-year Treasury yield has actually retreated recently to 4% or less, while Treasury Inflation-Protected Securities (TIPS) imply an inflation rate of merely 2.3%.

Two additional considerations warrant attention. First, central banks globally have increased gold purchases to strengthen their reserves. Geopolitical uncertainty and dollar weakness have accelerated this trend. Second, although the dollar has weakened approximately 10% this year, it remains at elevated levels within its twenty-year range. From a historical perspective, therefore, the dollar maintains considerable strength.

Predicting gold rallies remains challenging

As a speculative holding, gold naturally attracts investor interest. Throughout recent decades, gold has experienced significant rallies with varying outcomes. During the late 1970s, gold soared amid stagflation concerns and questions about Fed independence. Prices peaked above $800 in 1980 - a threshold not revisited until 2007.

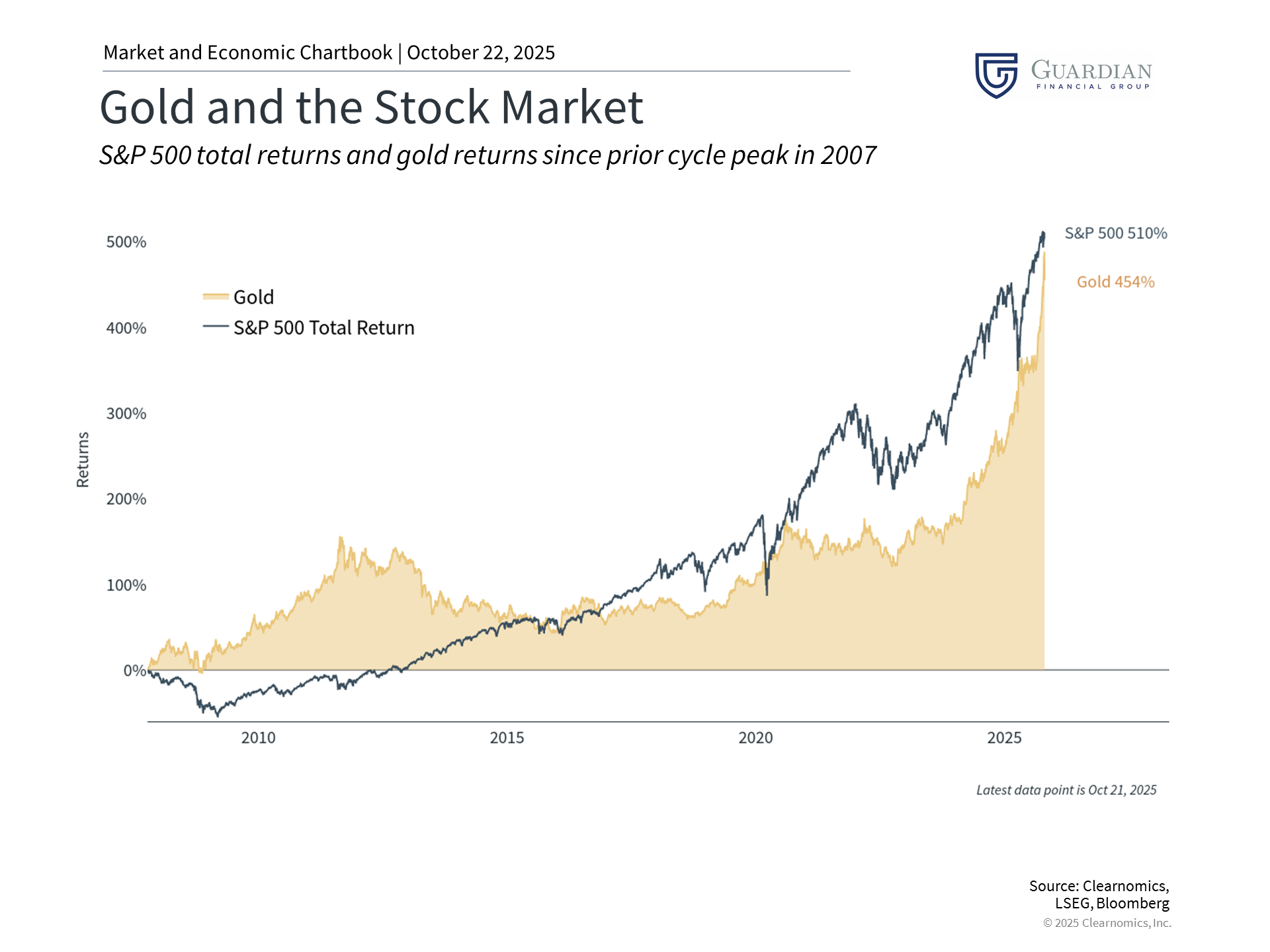

Following the 2008 financial crisis, a comparable pattern emerged as central banks deployed massive stimulus. Many investors reasonably feared runaway inflation and dollar collapse, though neither materialized. Gold doubled between 2009 and 2011, approaching $1,900 per ounce, before declining toward $1,000 over subsequent years. This occurred despite the Fed not beginning to reduce stimulus until 2013 or raising rates from the zero bound until 2015.

The accompanying chart illustrates gold's performance relative to the S&P 500 since the 2007 market peak. Although gold delivered strong performance during certain periods, providing diversification advantages, the S&P 500 has delivered superior returns across the complete timeframe. For investors preoccupied with daily equity market fluctuations, this reality may appear counterintuitive. This underscores the importance of evaluating all asset classes from a comprehensive portfolio perspective.

Multiple asset classes have driven portfolio gains this year

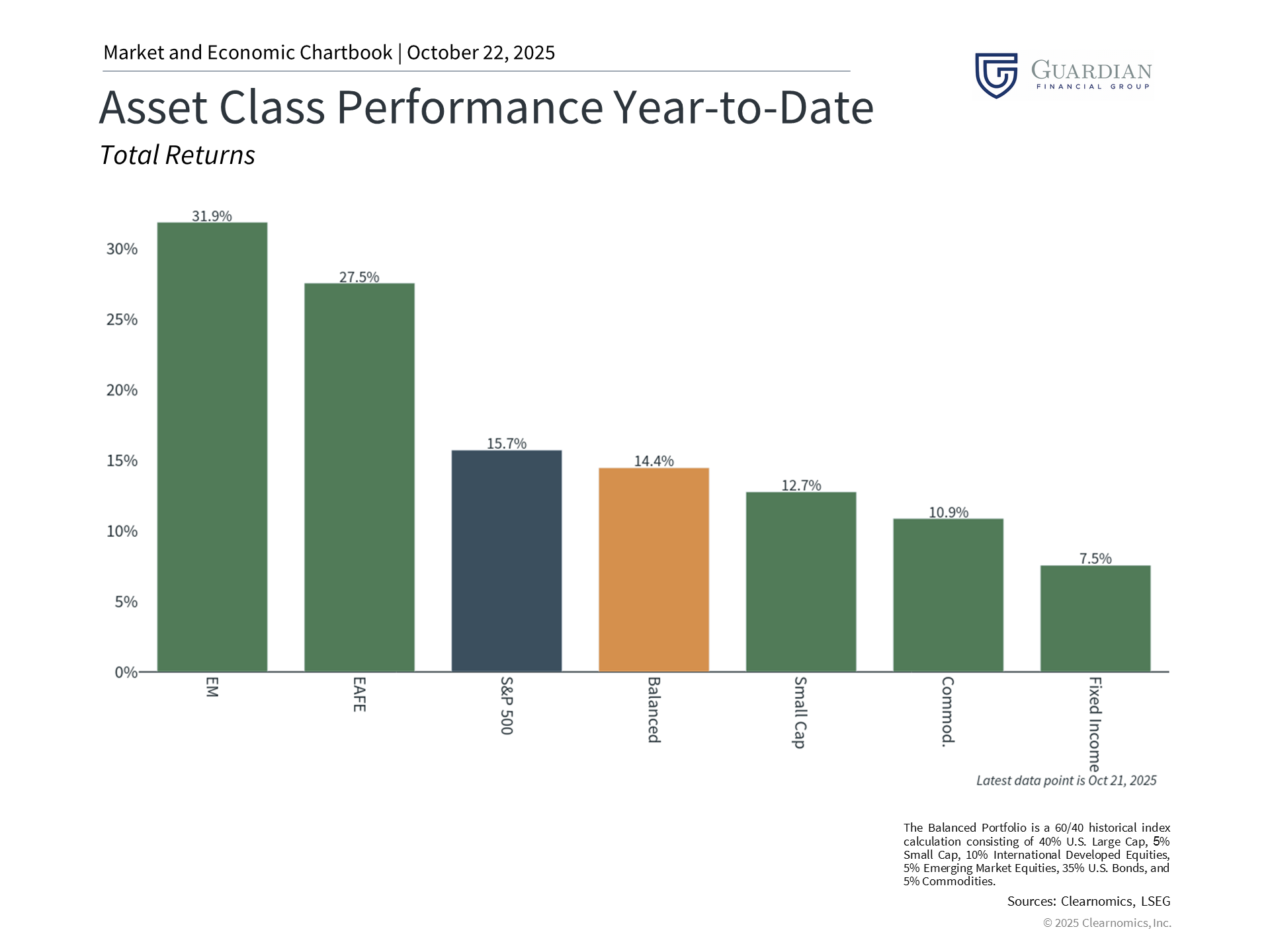

The present gold rally, which commenced in 2024, coincides with robust performance across numerous assets, including artificial intelligence equities like the Magnificent 7, international equities, fixed income, and cryptocurrencies. The accompanying chart demonstrates that various asset classes have enhanced portfolio returns this year. While gold has certainly delivered strong results, individual securities and other assets that excel during any particular year will always exist.

For numerous investors, gold functions as part of a wider commodities allocation, potentially connected to other alternative asset categories. The Bloomberg Commodity Index, for example, started the year with a 14.3% target allocation to gold. Alongside other commodities including silver, industrial metals, energy, grains, and others, this index has advanced 10.6% year-to-date.

Additional rationales support maintaining diversified holdings across multiple asset classes aligned with long-term financial objectives. One fundamental consideration is that gold produces no income, unlike fixed income securities or dividend-paying equities. Therefore, a portfolio with excessive gold concentration sacrifices the longer-term appreciation potential of equities and the income generation of bonds.

The bottom line? While some investors worry about dollar debasement, particularly as gold continues rallying, gold should be viewed as one element within a diversified portfolio constructed to support long-term financial objectives. | |||

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Guardian Financial Group are not affiliated. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.  |