Should You Sell After the China Trade Market Drop?

| |||

Navigating Market Swings Amid Ongoing Trade TensionsOctober 13, 2025 | |||

Recently, financial markets witnessed their steepest single-day drop since April, sparked by heightened trade friction between the United States and China concerning rare earth materials and tariff announcements. Though this brief downturn unsettled certain market participants, conditions stabilized relatively quickly after the administration adopted more moderate trade rhetoric. For those investing with a long-term horizon, such fluctuations may seem familiar following an extended stretch of market stability.

Even with tariff-related headwinds throughout the year, market performance has been impressive. The S&P 500, Nasdaq, and Dow have all delivered double-digit percentage returns. Fixed income investments have also contributed positively to portfolio performance, with the Bloomberg U.S. Aggregate Index advancing 6.7%, marking an unusually robust year for bonds. International equity markets have surpassed U.S. performance, with developed markets rising 21.9% and emerging markets climbing 27.0%. Given this backdrop, it's crucial not to allow one difficult trading session, accompanied by pessimistic media coverage, to influence core investment strategies.

Rather than causing alarm, market fluctuations should reinforce the understanding that near-term variability is an inherent aspect of investing. Preserving a long-range outlook continues to be essential for achieving financial objectives. Comprehending the factors behind market reactions and ensuring appropriate portfolio diversification can assist investors in remaining committed to their extended goals.

Recent trade friction and the rare earth materials situation

The recent market turbulence stemmed from China's new limitations on rare earth material exports, which prompted the administration to propose an additional 100% tariff on Chinese imports beyond current levies. This development continues the pattern of reciprocal actions that has generated uncertainty for both investors and corporations throughout the year. Encouragingly, the administration has since moderated its stance and suggested that diplomatic discussions may occur in upcoming weeks.

What exactly are rare earth materials, and why have they become central to trade disputes? Unlike numerous other imported goods and services, rare earth materials are predominantly sourced from China. While these elements are not actually scarce from a geological standpoint, China has developed substantial extraction and refinement infrastructure over multiple decades, eclipsing all competing nations. These substances are essential inputs for numerous advanced technologies, including mobile devices, electric automobiles, energy storage systems, defense equipment, and sophisticated electronics.

Given these factors, rare earth materials constitute one of China's most significant bargaining chips regarding trade relations and international affairs with the United States and global partners. Current estimates indicate that China commands roughly 70% of worldwide rare earth material production and close to 90% of refinement capacity, establishing supply chain dependencies for other nations. The United States maintains strategic reserves of rare earth materials and has authorized executive directives to expand domestic production, though implementation requires considerable time.

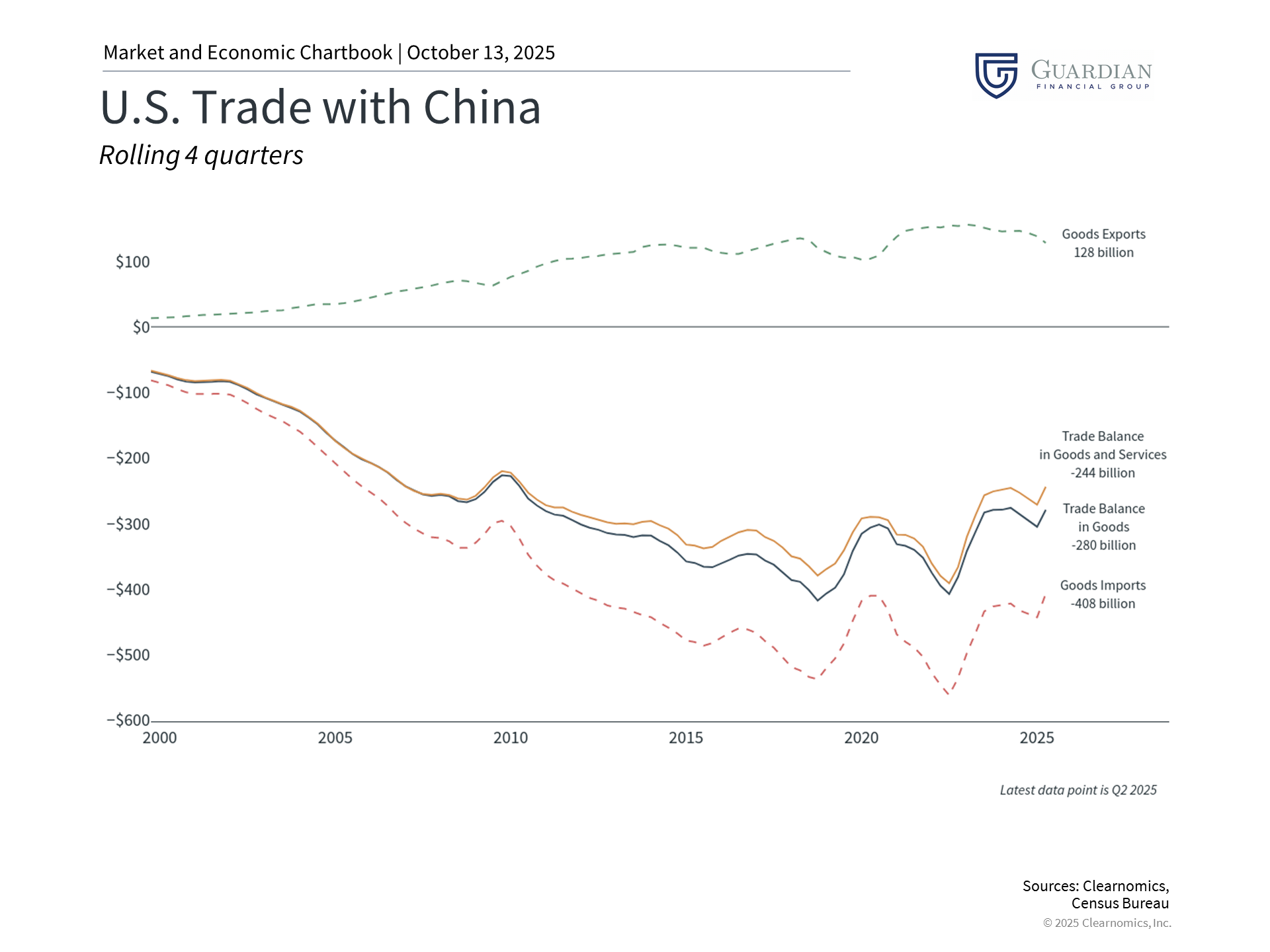

Discussions surrounding rare earth materials represent just one element of the administration's broader trade strategy with China. As illustrated in the accompanying chart, the United States continues to maintain a substantial trade deficit with China, and narrowing this gap while promoting domestic industry has been among the administration's policy priorities.

Outcomes thus far have been varied—while certain manufacturing operations have relocated to the United States and announcements of new capital investments have been made, supply networks cannot transform instantaneously. The recent softening in employment conditions has complicated matters: according to the August jobs report, manufacturing sector employment had contracted by 78,000 positions year-to-date.

From an investment perspective, determining whether new tariff proposals should be interpreted literally or as negotiating tactics proves challenging. This ambiguity can trigger rapid changes in market sentiment and behavior. Consequently, it's essential to avoid excessive reactions to news coverage and allow situations to evolve while concentrating on longer-term developments. This approach proved valuable during the initial trade conflict in 2018 and 2019, and investors who responded impulsively earlier this year would have foregone the subsequent market rebound.

Market uncertainty has increased following a tranquil period

Recent market movements have elevated uncertainty and variability. This development is unsurprising given investor concerns about the market's forward price-to-earnings multiple hovering around 22.5x and questions regarding the durability of the artificial intelligence sector rally.

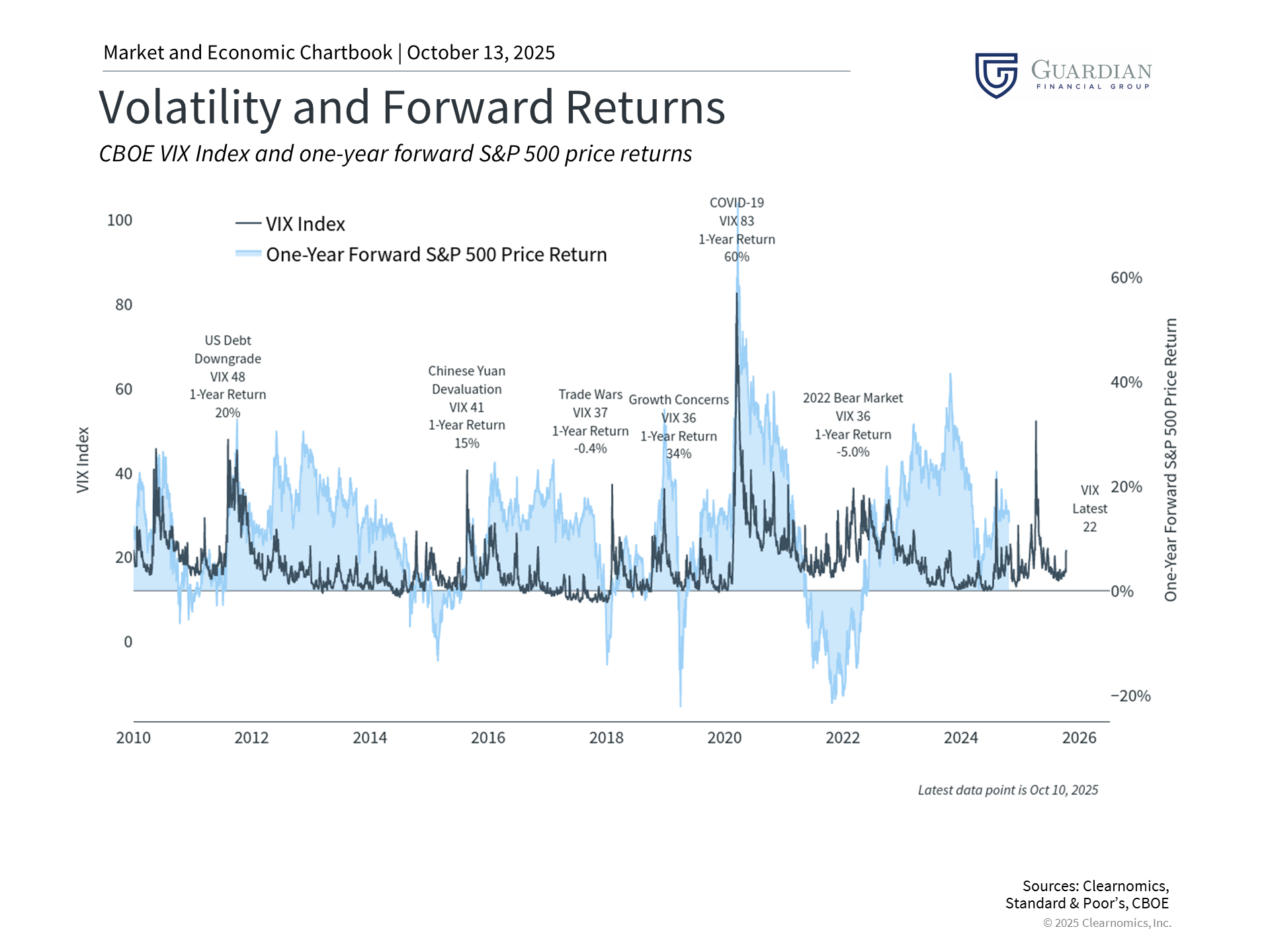

While understanding market drivers is valuable, historical evidence demonstrates that volatile periods frequently present the most favorable investment prospects. Near-term anxieties often produce more attractive valuations, which subsequently benefit long-term portfolios. The difficulty of investing during turbulent times is precisely why investors with the discipline to do so are compensated.

The accompanying chart illustrates the connection between the VIX index, which gauges stock market volatility, and subsequent one-year S&P 500 returns. Throughout history, VIX increases have frequently preceded robust forward returns, as these moments coincide with investor apprehension about market entry or ill-timed selling. This pattern reveals how detrimental overreacting to market swings can be.

Market results have been positive despite pessimistic attitudes

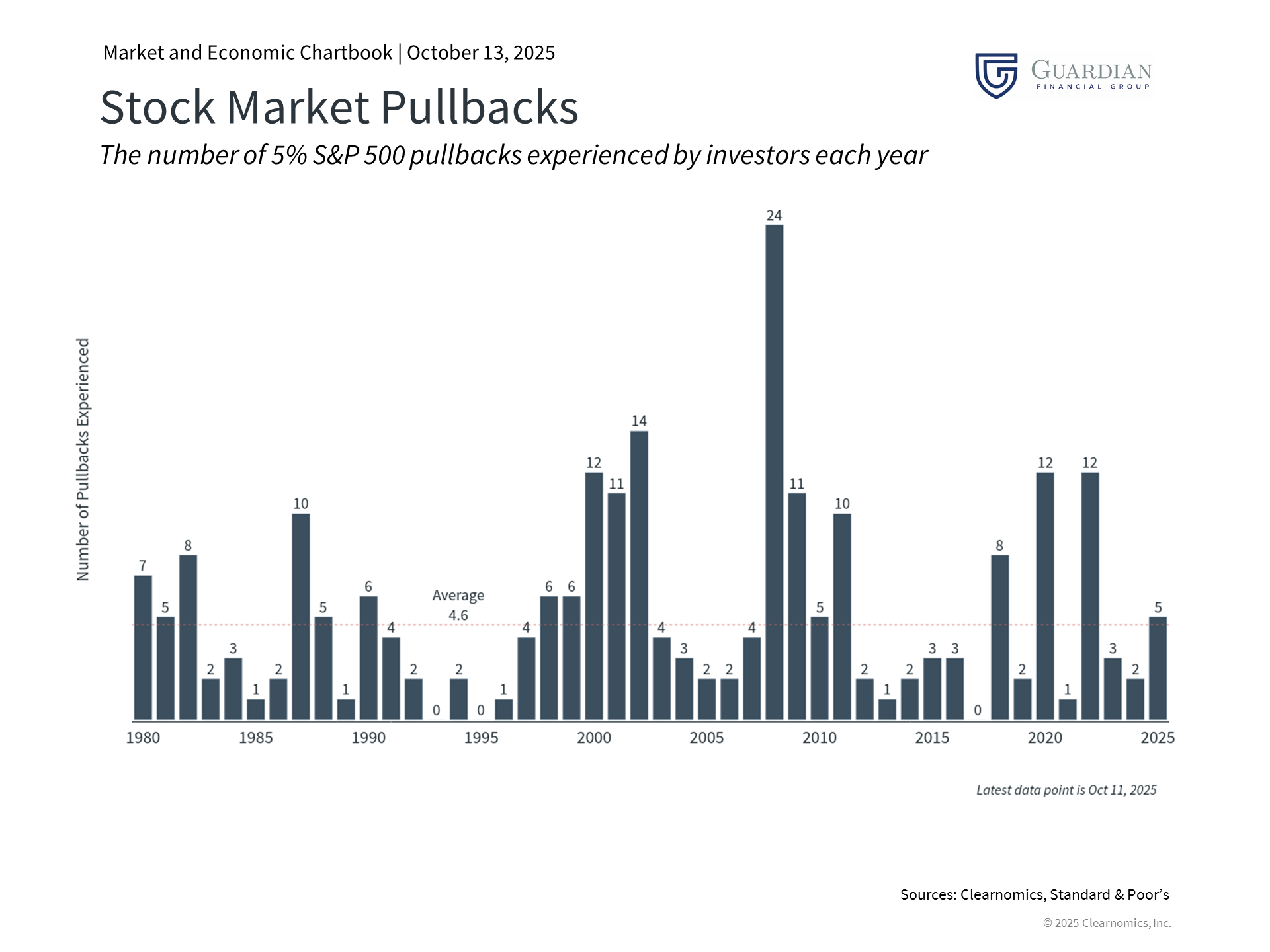

Although the 2.7% decline on October 10 ranked as the fourth most significant down day of the year for the S&P 500, maintaining context remains important. The accompanying chart demonstrates that market corrections of 5% or greater occur routinely, even during positive years. While this year has seemed turbulent, the actual frequency of pullbacks has been fairly typical when assessed against market behavior over the preceding 45 years. Indeed, the market has exceeded forecasts this year with the S&P 500 advancing 31.5% from its April "Liberation Day" trough, establishing over 30 fresh all-time peaks year-to-date.

The key insight is not that markets always ascend steadily, as they clearly do not. Rather, it's that episodes of market uncertainty are both ordinary and anticipated, and investors should remain prepared for short-term turbulence. Resisting the impulse to fret over every new development that might disrupt markets represents one of the fundamental principles of long-term financial achievement.

The bottom line? Brief episodes of market variability can be uncomfortable but are ordinary and anticipated, particularly as trade frictions between the United States and China persist. Historical patterns indicate that periods of elevated uncertainty, though unsettling, frequently create the most compelling opportunities for disciplined investors. | |||

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Guardian Financial Group are not affiliated. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.  |