Will AI Replace Software Companies and Your Job?

| |||

AI's Impact on Markets: What Investors Should KnowFebruary 11, 2026 | |||

A decade and a half ago, venture capitalist Marc Andreessen made a prescient observation: "software is eating the world." His prediction was that any service capable of being automated through software eventually would be. This forecast has proven remarkably accurate, as cloud computing, software-as-a-service models, and digital platforms have fundamentally transformed industries and consumer behavior. For investors, these shifts carry significant implications and contribute to current market turbulence.

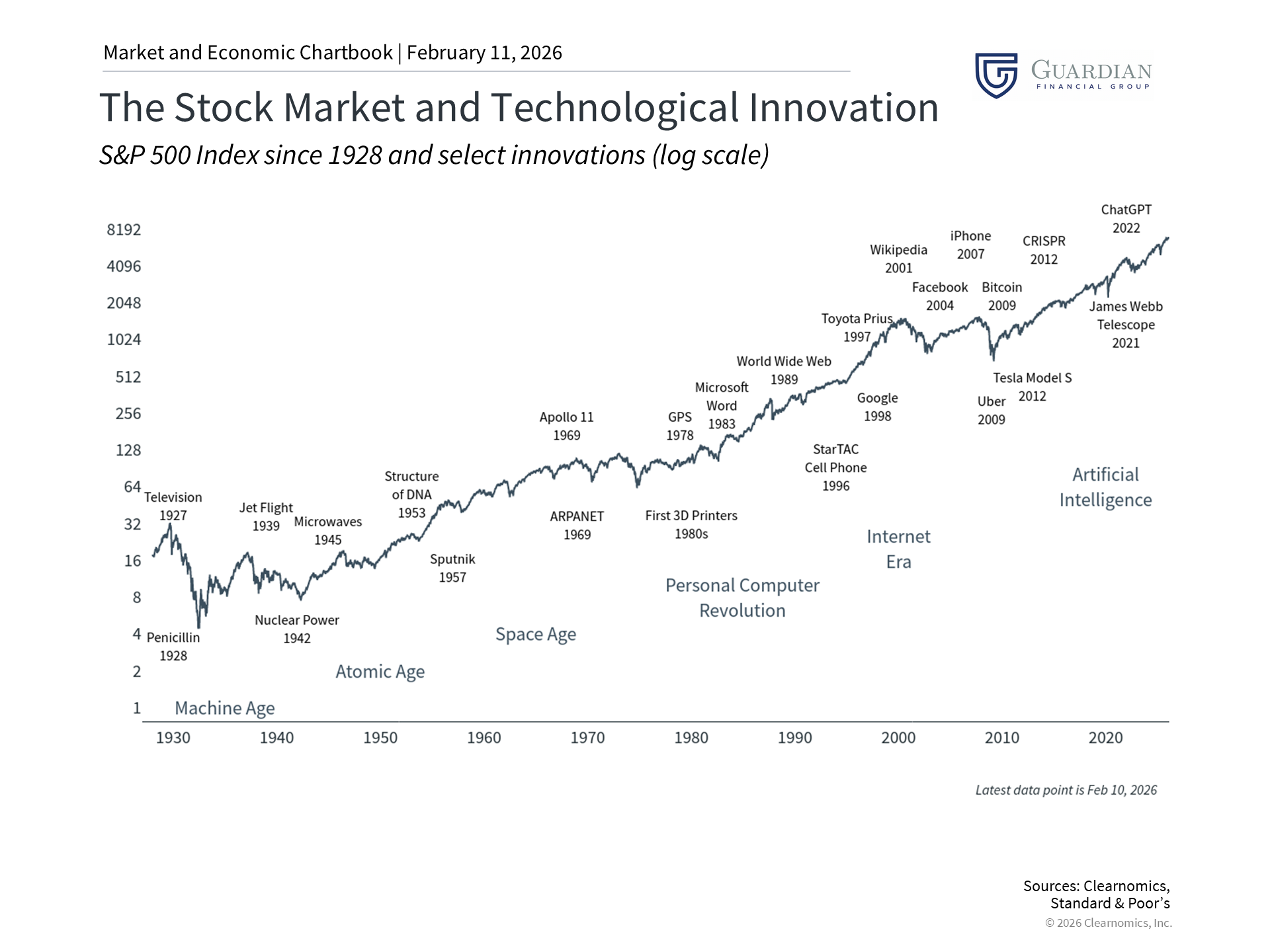

AI now represents the latest chapter in this ongoing transformation. As with previous major technological breakthroughs, markets are grappling with its implications for individual sectors and the broader economy. For investors with a long-term horizon, understanding how similar cycles have evolved historically can offer valuable perspective.

Innovation inherently brings disruption, and recent volatility in technology stocks—marked by sharp declines followed by rapid recoveries—illustrates the difficulty of forecasting these trends. When Anthropic, a prominent AI company, unveiled new automation capabilities that could replicate tasks traditionally performed by specialized software in fields like legal and financial research, it prompted markets to reconsider established software business models. Additionally, several major technology companies faced stock pressure after disclosing capital expenditures exceeding one hundred billion dollars quarterly on AI infrastructure, leading to questions about return on investment.

Notably, this occurred almost precisely one year following the "DeepSeek moment" in January 2025, when a Chinese AI firm claimed to have developed AI models at dramatically reduced costs. In both instances, markets reassessed which companies would emerge as winners or losers from technological advancement, yet recovered swiftly once uncertainty subsided. For investors, these episodes highlight the importance of maintaining a long-term outlook as markets oscillate between recognizing innovation's potential and confronting disruption's challenges.

Historical patterns emerge in technological disruption

While current AI-related uncertainty may seem unique, history demonstrates that technological disruptions typically follow recognizable patterns. Reflect on how dramatically software usage has evolved over recent decades—from physical products purchased in boxes and installed on individual computers, to internet-connected mobile devices, to becoming integral to how we work, communicate, shop, bank, and seek entertainment today. Each wave of innovation creates distinct "old economy" and "new economy" categories, requiring markets to determine where companies fit.

AI possesses the capacity to transform how services are fundamentally created, extending the trend of software replacing traditional processes. Nevertheless, even the most revolutionary technologies don't eliminate the need for specialized knowledge and services. Regardless of their capabilities, AI systems will continue requiring access to superior data, dependable platforms, and distinctive domain expertise. Likewise, consumers will maintain their preference for trust, personalization, and quality results.

The companies best positioned to deliver these services may evolve, but the core needs likely won't disappear. Just as consumers don't manufacture their own vehicles or reassemble them for each grocery trip, AI applications will continue depending on existing infrastructure and specialized capabilities. Over time, this typically benefits consumers through enhanced products, reduced costs, and greater service accessibility.

Maintaining realistic expectations about transformation timelines is equally important. Although AI companies have forecast the arrival of "artificial general intelligence" or "artificial super intelligence" in recent years, emerging evidence suggests that advancement in AI training has moderated somewhat. That acknowledged, current AI capabilities are already impressive and clearly sufficient to reshape investor expectations.

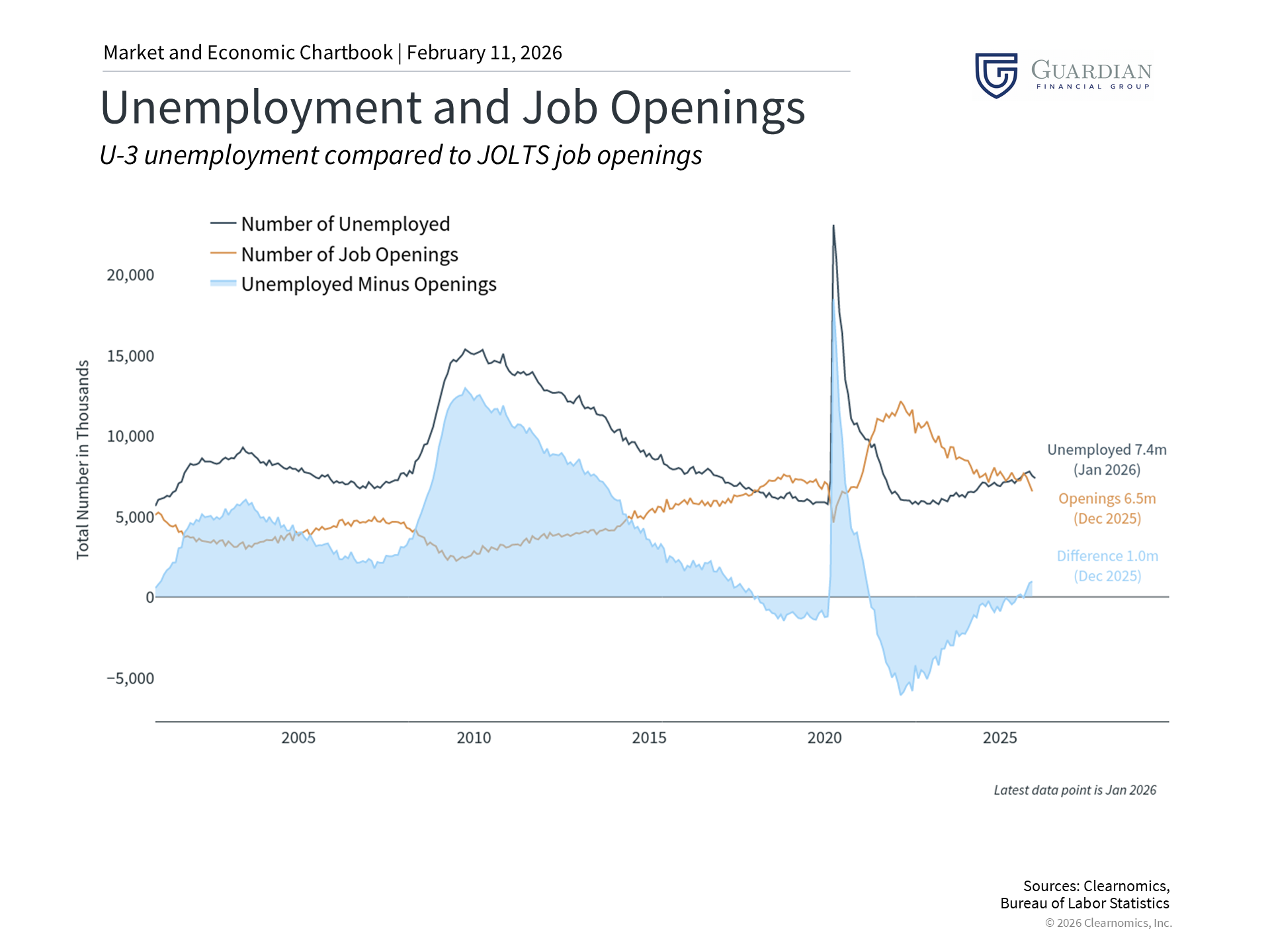

Labor market dynamics compound economic concerns

Compounding investor anxiety is a labor market that has softened since mid-2025. Recent Bureau of Labor Statistics data revealed that job openings dropped to their lowest level since 2020 in December. At its height, there were over two job openings for each job seeker, but this ratio has now fallen below one, with approximately 6.5 million openings for 7.5 million unemployed individuals. Concurrently, Challenger, Gray & Christmas reported that job cuts surged to 108,435 in January, representing a 118% year-over-year increase and the highest January figure since 2009.

While direct evidence linking these job cuts to AI remains absent, these developments nonetheless influence the broader economic outlook. Historically, every significant technological wave—from the Industrial Revolution through the Information Technology Revolution—has ultimately generated more employment than it eliminated, though transition periods requiring worker retraining can prove challenging for individuals and society alike.

Meanwhile, a softer job market has prompted concern among some investors following years of above-expectation economic expansion. This carries implications for the overall outlook and Federal Reserve policy trajectory. Other economic indicators remain robust, including sustained consumer spending supported by household wealth near record highs and inflation holding steady under 3%. Consequently, while certain economic headwinds exist, there are also grounds for optimism about continued healthy growth.

Portfolio implications of these developments

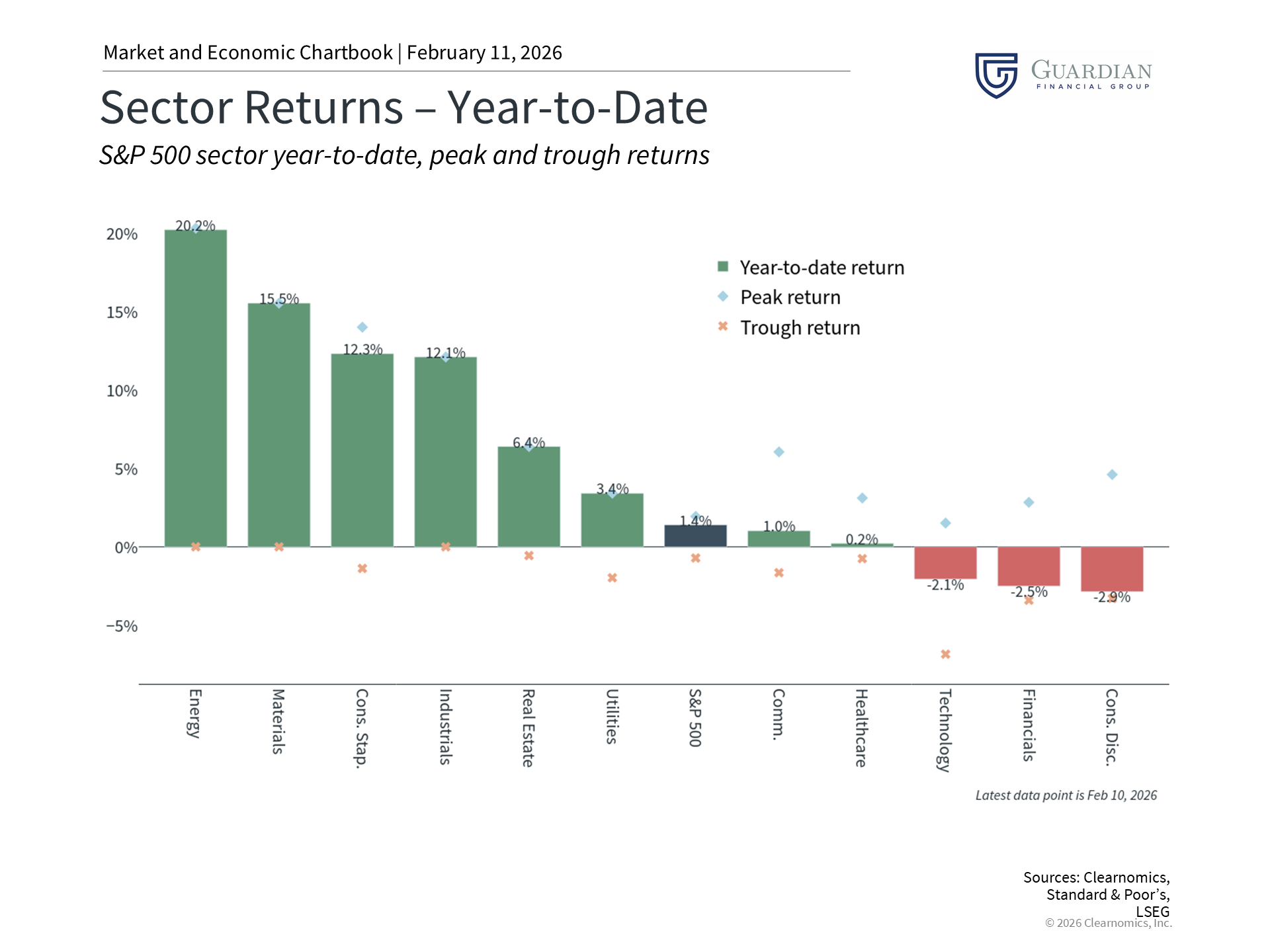

For investors, recent turbulence reinforces that asset allocation carries more weight than any individual trend or headline. The Information Technology and Communication Services sectors, despite delivering robust returns in recent years, are characterized by volatility as expectations evolve. These sectors demonstrate sensitivity to long-term factors including interest rates, making them vulnerable to uncertainty surrounding the Fed. While groups like the Magnificent 7 have excelled over recent years, they can underperform during periods like 2022 and the past two months.

The most significant question concerns stock market valuations. With the S&P 500's price-to-earnings ratio approaching historically elevated territory, investors have been shifting toward other sectors including Consumer Staples, Energy, Materials, and Industrials. This potentially signals markets becoming more discriminating and identifying opportunities beyond AI. After all, AI capturing investor attention doesn't preclude attractive opportunities elsewhere in the market.

Cryptocurrencies have also experienced substantial declines recently, with Bitcoin falling 50% to slightly above $60,000 before partially recovering. This underscores that, from a portfolio standpoint, cryptocurrencies remain highly volatile assets susceptible to sentiment shifts that frequently lack straightforward explanations. For those considering these assets, determining their role within a balanced portfolio far outweighs attempting to time market movements.

Ultimately, current AI developments should be evaluated within the broader context of other market and economic shifts. If historical patterns hold, markets will likely overreact and underreact to these trends in the near term. History demonstrates that investors who remain patient and appropriately positioned will be best equipped to accomplish their financial objectives.

The bottom line? Although AI is prompting reassessment of particular stocks and sectors, fundamental principles of long-term investing remain constant. Maintaining a portfolio aligned with your financial objectives remains the most effective approach for navigating periods of rapid transformation. | |||

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Guardian Financial Group are not affiliated. Copyright (c) 2026 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.  |