Why Did Markets Hit New Highs Despite Fed Uncertainty?

| |||

August Market Review: Stocks Reach New Peaks Amid Fed Policy Shifts and Strong Corporate ResultsSeptember 2, 2025 | |||

Equity markets achieved fresh record highs during August while fixed income assets also delivered positive contributions to investor portfolios. This performance materialized despite ongoing concerns regarding tariffs, Federal Reserve autonomy, and technology sector volatility. The month opened with U.S. tariffs taking effect on major trading partners following the conclusion of an initial 90-day suspension period. Subsequently, a federal appeals court determined that these "reciprocal tariffs" violate legal standards, potentially setting the stage for Supreme Court review.

Mid-month market volatility emerged from worries that the Federal Reserve might maintain elevated interest rates for an extended period to combat inflation. Recent inflation data, including the Producer Price Index readings, indicate that businesses are starting to transfer tariff-related costs to consumers. Nevertheless, market optimism returned quickly due to corporate earnings that surpassed forecasts and increased confidence regarding potential Fed rate reductions at the September policy meeting.

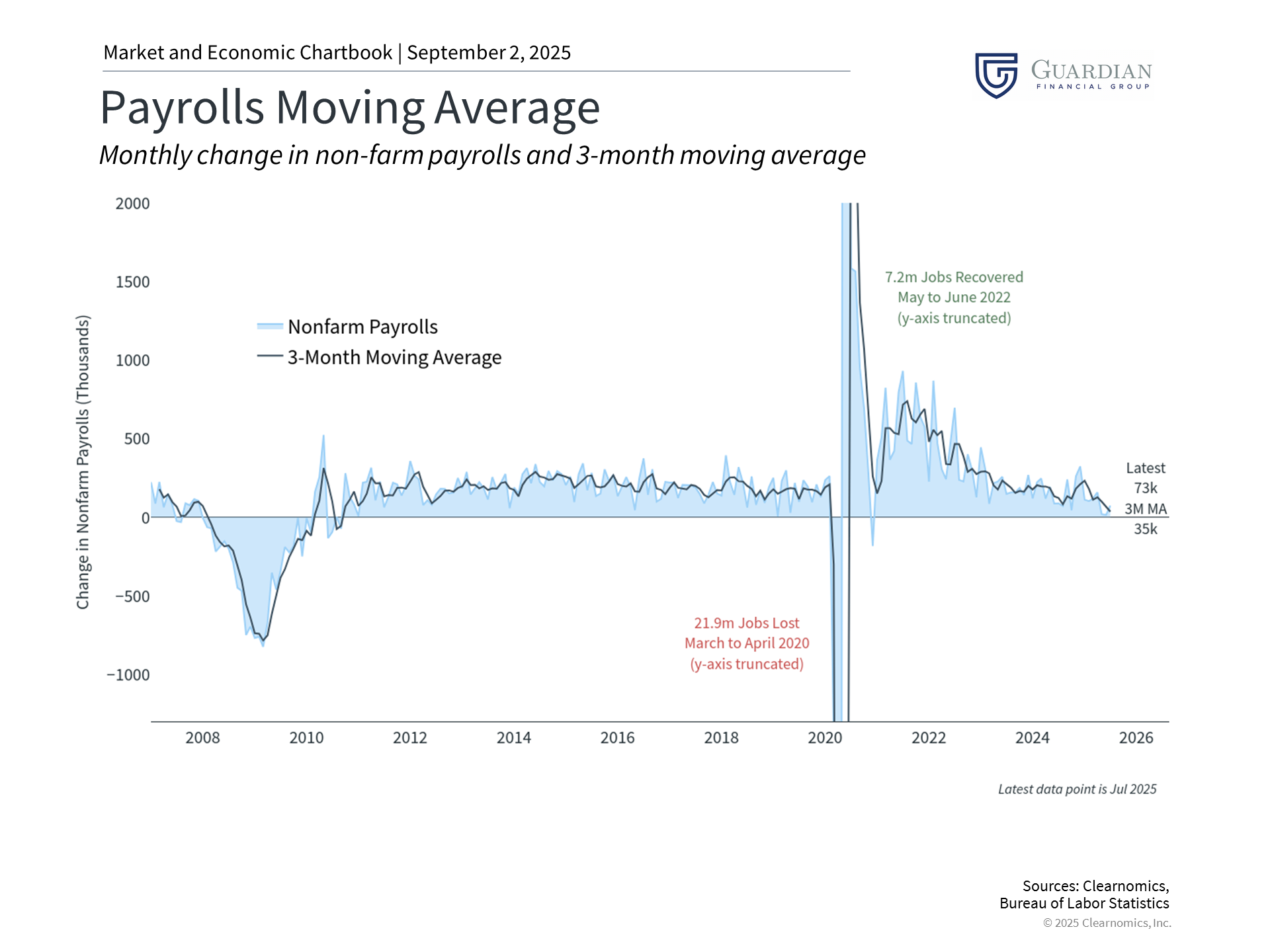

Economic data presented a mixed picture. Second quarter GDP growth received an upward revision from 3.0% to 3.3%, marking a substantial recovery from the first quarter's 0.5% contraction. Conversely, the monthly employment report revealed a sharp decline in job creation, accompanied by significant downward adjustments to previous months' figures. This development prompted the White House to dismiss the Bureau of Labor Statistics Commissioner, contributing to the uncertain policy environment.

Notwithstanding these headwinds, market volatility continues to register below historical norms. August's robust performance across both equity and bond markets highlights the value of maintaining balanced investment approaches with long-term perspectives.

Primary Market and Economic Factors

Equity markets advanced on robust corporate performance

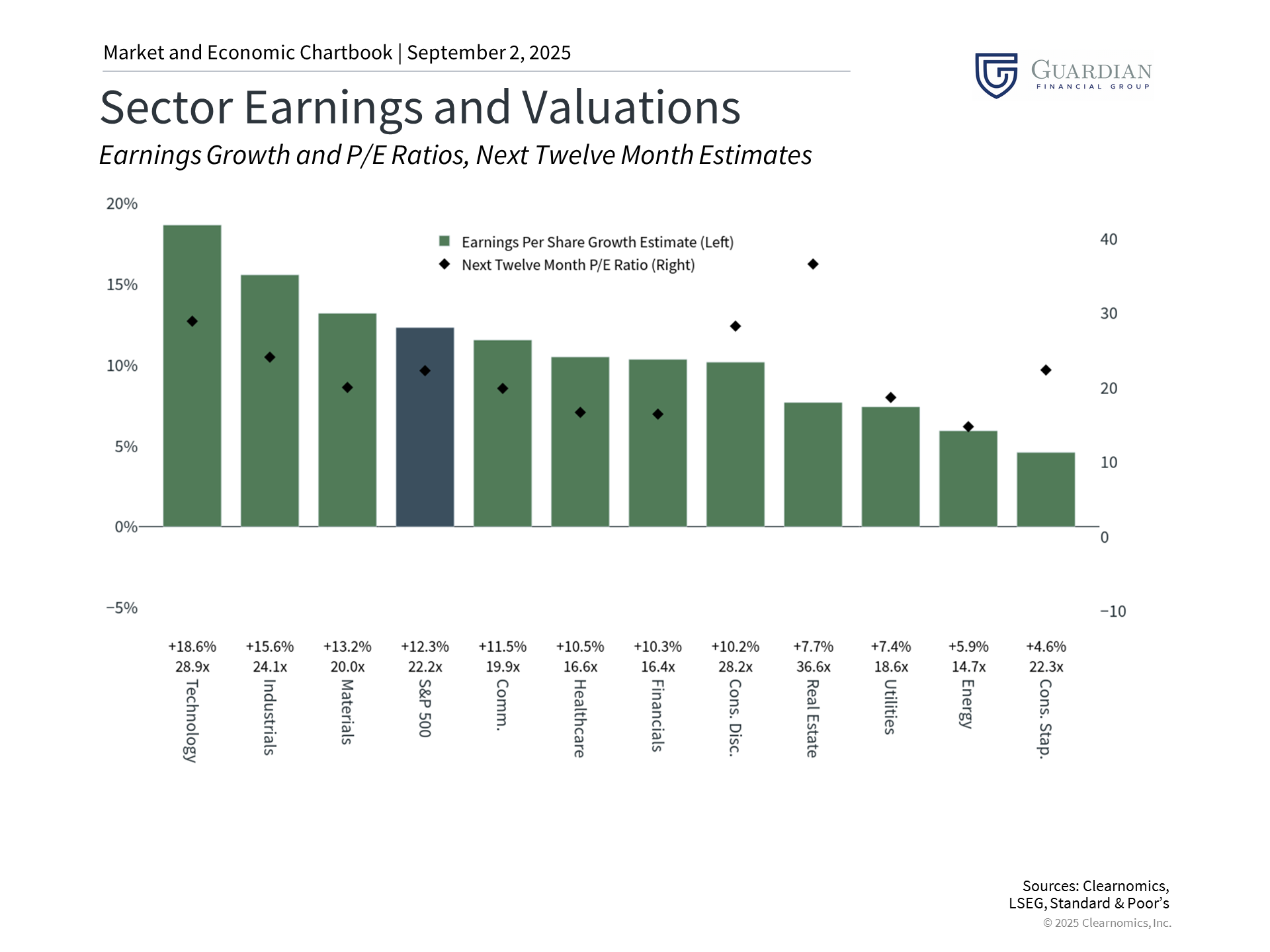

While daily news cycles and headlines may influence market movements in the near term, fundamental factors such as corporate earnings and asset valuations determine portfolio performance over extended periods. Although equity market valuations appear elevated relative to historical benchmarks, this is justified by companies that maintain healthy earnings growth trajectories.

Recent earnings season data reveals that 81% of S&P 500 companies exceeded analyst expectations, based on FactSet research. This represents the highest percentage since the third quarter of 2023, indicating that economic conditions and corporate fundamentals have proven more resilient than many anticipated.1 This also highlights corporate adaptability as businesses navigate tariff implementation, absorb increased costs, and identify growth opportunities amid policy uncertainty.

Significant investor attention centers on the earnings and performance of the Magnificent 7, a collection of mega-cap corporations, some with market capitalizations exceeding multiple trillion dollars. This group currently comprises more than one-third of the S&P 500, making their performance crucial for broader market direction. While earnings results for this group showed variation, several of these "hyperscalers" surpassed expectations. Despite ongoing "AI bubble" concerns, these outcomes contributed to a market rally during August's latter half.

Federal Reserve policy shifts toward rate reductions

Conversely, consumer-oriented companies reported varied outcomes reflecting shifts in household spending behavior. This situation is intensified by tariff implementation, as firms transfer a larger share of tariff costs to end consumers. When combined with disappointing employment data, markets began pricing in more aggressive rate cuts starting in September.

Fed Chair Jerome Powell, speaking at the annual Jackson Hole, Wyoming conference, delivered the most definitive indication that the central bank stands ready to resume interest rate cuts after this year's pause. The Fed operates under a "dual mandate" to maintain price stability and full employment. Recently, they have maintained relatively elevated interest rates due to persistent inflation and robust labor market conditions. Therefore, emerging signs of labor market weakness could influence Fed decision-making toward measured rate reductions.

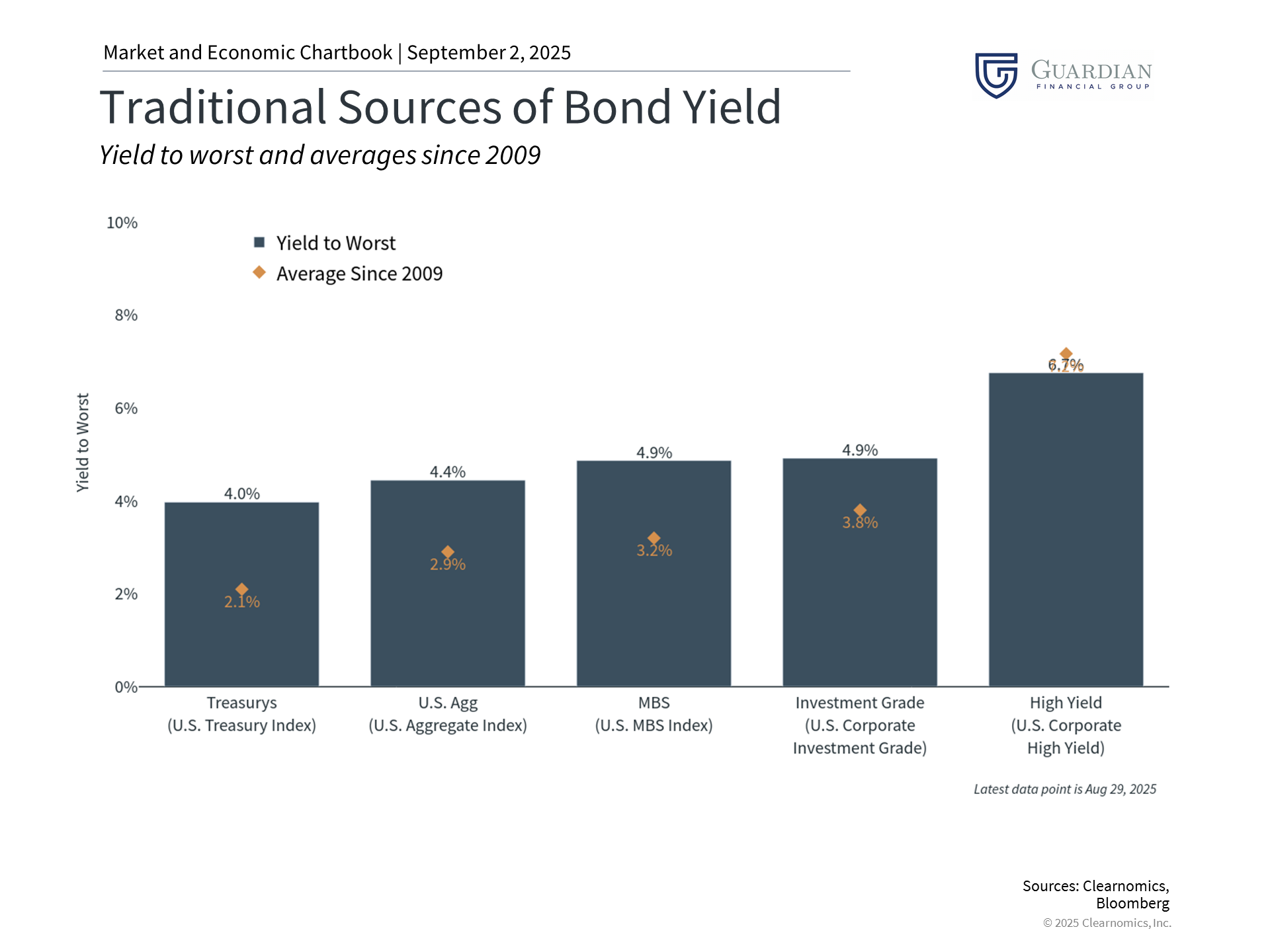

Rate cuts may generate opportunities across multiple asset categories

The possibility of further Fed rate cuts could generate opportunities across various asset categories. Beyond supporting overall economic expansion, reduced interest rates can improve corporate borrowing conditions, lower barriers for new investments, and enhance the present value of future cash flows. For fixed income securities, declining interest rates increase the value of existing bonds issued at higher yields.

Bond yields have remained within a relatively tight range this year, with the 10-year Treasury yield typically oscillating between 4.0% and 4.5%. Even as short-term yields may decrease with Fed rate cuts, numerous bond sectors continue offering attractive income levels. The U.S. aggregate bond index currently yields 4.4%, investment-grade corporate bonds provide 4.9%, and high-yield bonds offer 6.7%. These yields significantly exceed historical averages and strengthen balanced portfolio approaches.

For comprehensive portfolios, investors should maintain focus on managing various risk and return components. Issues including tariffs, Fed policy decisions, and potential government shutdown risks in Washington represent just some of the challenges investors will encounter in coming months. Instead of responding to individual events, maintaining a portfolio capable of weathering these fluctuations while delivering both income and long-term appreciation remains the optimal approach for achieving financial objectives.

The bottom line? Markets achieved fresh all-time highs in August despite numerous policy uncertainties. Strong corporate earnings and economic growth continue supporting portfolios amid persistent uncertainty.

1.https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_082925.pdf | |||

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Guardian Financial Group are not affiliated. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.  |