How Credit Downgrades, Budget Battles, and Fiscal Policies Impact Investors

| |||

How Credit Downgrades, Budget Battles, and Fiscal Policies Impact InvestorsMay 19, 2025 | |||

With Moody's recent downgrade of U.S. credit from Aaa to Aa1, all three major rating agencies have now removed America's top-tier debt status. This follows Fitch's action in 2023 and Standard & Poor's initial downgrade in 2011. Moody's decision reflects mounting concerns about America's fiscal sustainability as Congress considers budget legislation that could potentially increase annual deficits. The downgrade highlights the tension between extending tax cuts and maintaining fiscal health. As these economic and political uncertainties unfold, investors are naturally questioning the implications for their financial strategies.

Market uncertainty typically accompanies budget negotiations

The past fifteen years have witnessed considerable market volatility during budget discussions and debt ceiling confrontations. Notable examples include Standard & Poor's 2011 U.S. debt downgrade, the 2013 fiscal cliff scenario, and government shutdowns in 2018-2019. Despite initial market turbulence, resolutions were eventually reached in each case, allowing markets to regain stability and continue their upward trajectory.

Interestingly, following the unprecedented 2011 downgrade and subsequent market correction, the S&P 500 fully recovered within months. Perhaps counterintuitively, even with these credit downgrades, U.S. Treasury securities continue to function as safe-haven assets during market volatility and remain fundamental to global financial markets.

When considering national debt and Congressional budget conflicts, perspective is essential. As citizens and voters, concerns about the nation's fiscal sustainability are legitimate. These challenges lack simple solutions, as evidenced by numerous commissions and proposals that have failed to meaningfully reduce annual budget deficits.

While these fiscal issues merit attention, they shouldn't prompt overreactions with investment portfolios. Historical evidence shows markets typically recover from fiscal challenges and downgrades over time. Focusing on long-term objectives, diversification, and fundamental investment principles—rather than reacting to Washington headlines or expecting Congress to resolve deficit issues—remains the most effective approach to achieving financial goals.

Moody's downgrade arrives at a pivotal moment as investor focus shifts from tariffs to Washington's budget proposals. Although markets performed well after last year's presidential election, partly due to expectations of growth-friendly policies and extensions of the Tax Cuts and Jobs Act of 2017 (TCJA), the Moody's announcement serves as a reminder about fiscal realities.

Moody's specifically noted that "successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs," adding that they "do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration."

Extensions or permanence for Tax Cuts and Jobs Act provisions are underway

Congress is currently developing a new budget bill with provisions still in flux. The current proposal seeks to provide certainty by extending individual tax cuts from the TCJA that would otherwise expire after 2025. This would prevent a potential "tax cliff" where rates would revert to pre-TCJA levels, potentially disrupting economic stability. By addressing these issues well ahead of expiration, policymakers aim to create a more predictable environment for both consumers and businesses.

The proposed tax package includes numerous provisions affecting individuals and businesses alike. Key elements, which remain subject to modification, include:

For Individuals:

For Businesses:

The proposal notably lacks provisions for a "millionaire tax" or changes to carried interest taxation that some had anticipated. Additionally, the debt ceiling could potentially be raised by $4 trillion.

Ongoing deficits may increase national debt

Though the current proposal includes approximately $1.6 trillion in spending reductions through modifications to programs like Medicaid and nutrition assistance, these cuts are overshadowed by tax reductions and spending increases elsewhere.

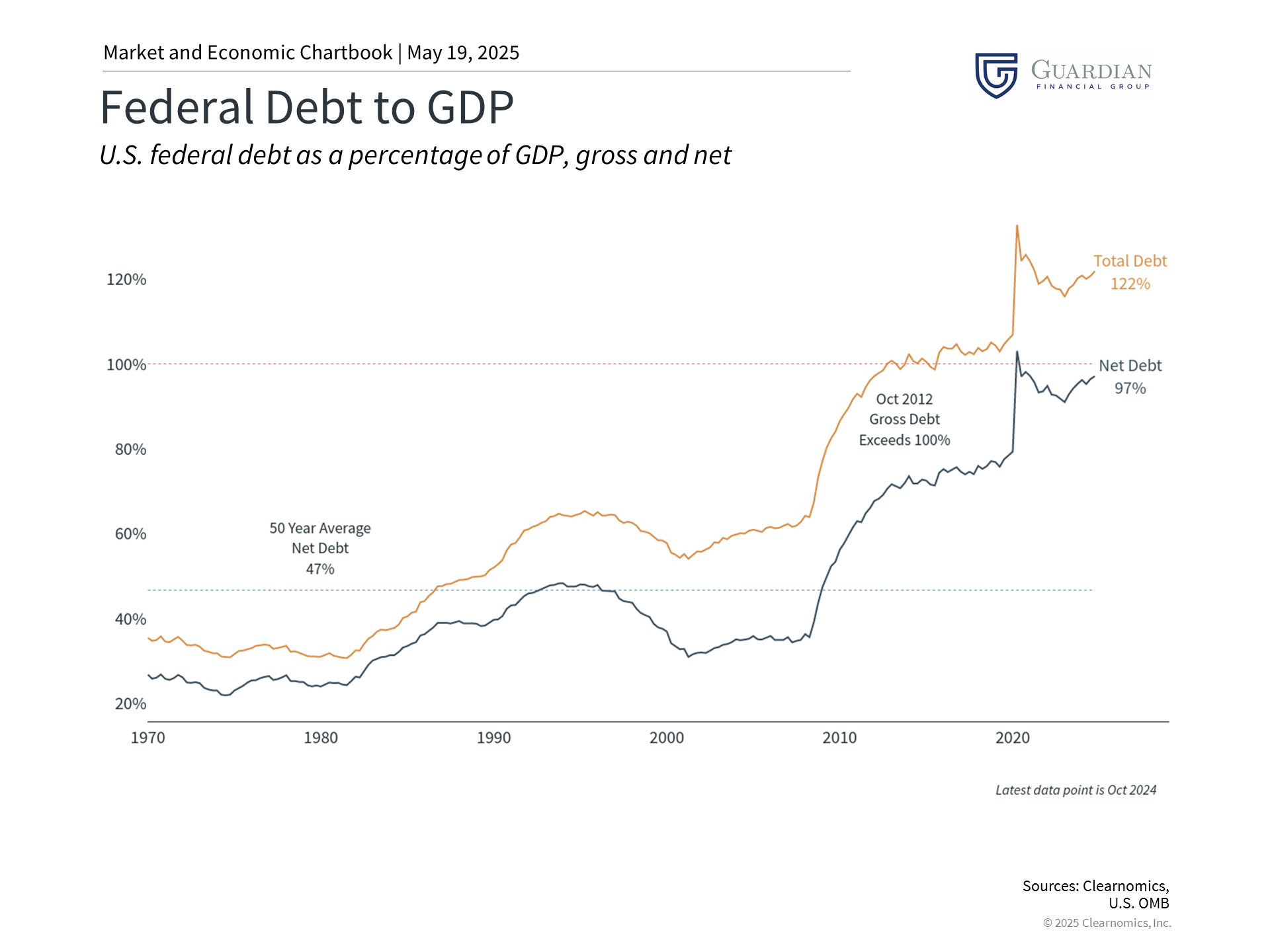

Annual budget deficits contribute directly to the national debt, which now exceeds $36 trillion—roughly $106,000 per American citizen. Reports indicate the proposed budget could add an estimated $3 trillion or more to the debt over the next decade. The Joint Committee on Taxation, a nonpartisan Congressional committee, projects the debt could grow by $3.7 trillion during this period.

The substantial growth of national debt in recent decades, accompanied by rising interest payments, is well-documented. With federal spending heavily allocated toward mandatory programs such as Social Security and Medicare, achieving consensus on significant spending reductions presents political challenges. This raises concerns that tax rates might eventually need to increase despite near-term extensions or permanent implementation of TCJA provisions.

While deficit and debt levels remain important factors for long-term economic health, their immediate impact requires proper context. Historically, markets have performed well across varying levels of government debt and deficit spending. Paradoxically, some of the strongest market returns over the past twenty years followed periods with the worst deficits, as these typically coincided with economic crises when markets were at their lowest. Consequently, basing investment decisions on government spending and deficits would have proven counterproductive.

The bottom line? The U.S. credit downgrade reflects persistent concerns about the nation's fiscal future. The ongoing budget negotiations may further complicate these challenges. However, historical patterns suggest investors are best served by maintaining their investments and adhering to long-term financial strategies. | |||

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Guardian Financial Group are not affiliated. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.  |