Can You Trust Government Economic Data for Investing?

| |||

Understanding Economic Data Reliability: Building a Complete Market ViewAugust 5, 2025 | |||

Investors navigating today's economic landscape face a challenging array of contradictory signals that complicate decision-making processes. Recent employment statistics revealed disappointing job creation alongside significant downward revisions to prior months, yet second-quarter GDP figures demonstrated renewed growth momentum. Meanwhile, corporate earnings results continue exceeding analyst projections, propelling equity markets to record levels, even as tariff implementations and persistent inflation pressures create ongoing concerns.

This mixture of conflicting economic indicators generates substantial uncertainty for both market participants and policy architects, complicating the formation of sound financial strategies when underlying data reliability comes into question.

The challenge extends beyond simply reconciling disparate current reports to encompass the fundamental complexity of economic analysis, which requires examining multiple interconnected factors including employment trends, price stability, productivity measures, government fiscal actions, and numerous other variables.

Rather than responding impulsively to isolated data releases, effective investment management demands understanding how to appropriately weight different indicators while identifying overarching economic patterns. Given today's uncertain macroeconomic backdrop, which key metrics should investors prioritize when constructing portfolios and developing long-term financial strategies?

Employment statistics reveal economic vulnerabilities

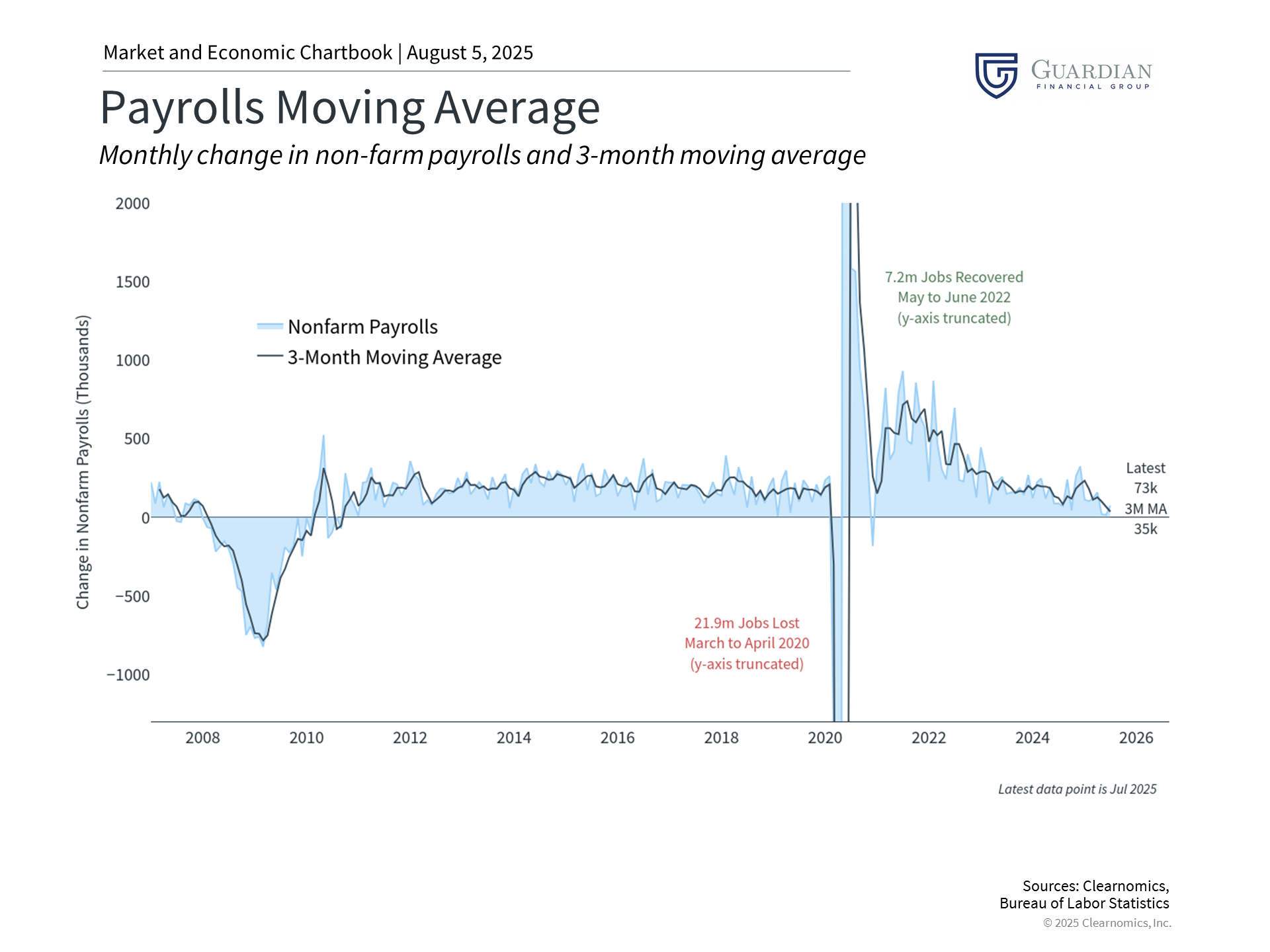

Recent employment data sparked significant concern after revealing merely 73,000 new positions created in July, falling substantially short of professional forecasts. More troubling were major downward adjustments to May and June employment calculations, collectively indicating 258,000 fewer positions than initially reported. These revisions suggest the economic foundation was considerably more fragile during recent months than originally understood.

The magnitude of these statistical corrections has intensified questions regarding government data credibility. This represents a critical challenge since official statistics provide the essential framework for comprehending economic movements. Whether examining employment figures from the Bureau of Labor Statistics, output measurements from the Bureau of Economic Analysis, or price indices from various federal agencies, these metrics inform everything from monetary policy decisions to investment allocation choices.

Within today's politically charged atmosphere, data reliability assumes heightened importance. Therefore, grasping several fundamental principles becomes essential.

Official statistics underpin investment strategy development

Initially, understanding the source of this complexity proves crucial. Certain measurements in life allow for precise counting. Company workforce sizes, termination events, or compensation adjustments can typically be calculated with exceptional accuracy. However, when scaling these calculations across millions of enterprises or hundreds of millions of individuals, direct counting becomes both impractical and potentially impossible. Statistical sampling and estimation methods become necessary tools.

Consequently, official data sources, like all statistical information, contain inherent imperfections. These figures derive from surveys encompassing thousands of businesses and households, conducted by professional researchers and analyzed by trained statisticians and economists. The quality of results depends entirely on survey design and analytical methodology, making all outputs estimates rather than precise measurements.

Additionally, a fundamental tension exists between speed, which market participants and policymakers demand, and accuracy, which requires time and supplementary information. Government economic releases follow rigid publication schedules, then undergo multiple revisions as additional data emerges. This revision process strengthens the system by enabling continuous accuracy improvements. Nevertheless, it means individual statistics should never be treated as definitive.

Despite these constraints, U.S. government statistics maintain industry recognition as the global benchmark when compared internationally. These organizations uphold rigorous standards and provide primary sourcing for numerous indicators. While methodological improvements remain ongoing possibilities, these agencies employ qualified professionals who have served across multiple political administrations.

Finally, political tensions surrounding government data remain unavoidable since strong incentives exist to present economic conditions favorably, while simultaneously making it difficult to verify whether political motivations influence specific reports. This dynamic has persisted across various political environments.

Comprehensive economic analysis requires multiple viewpoints

Given these complexities, examining numerous perspectives, including both governmental and private sector data, becomes essential for developing clearer economic understanding. Investment research frequently employs "mosaic theory," suggesting that diverse information pieces can construct comprehensive pictures. Employment conditions, economic growth, price pressures, corporate profitability, and consumer expenditure patterns from various sources all contribute valuable puzzle components.

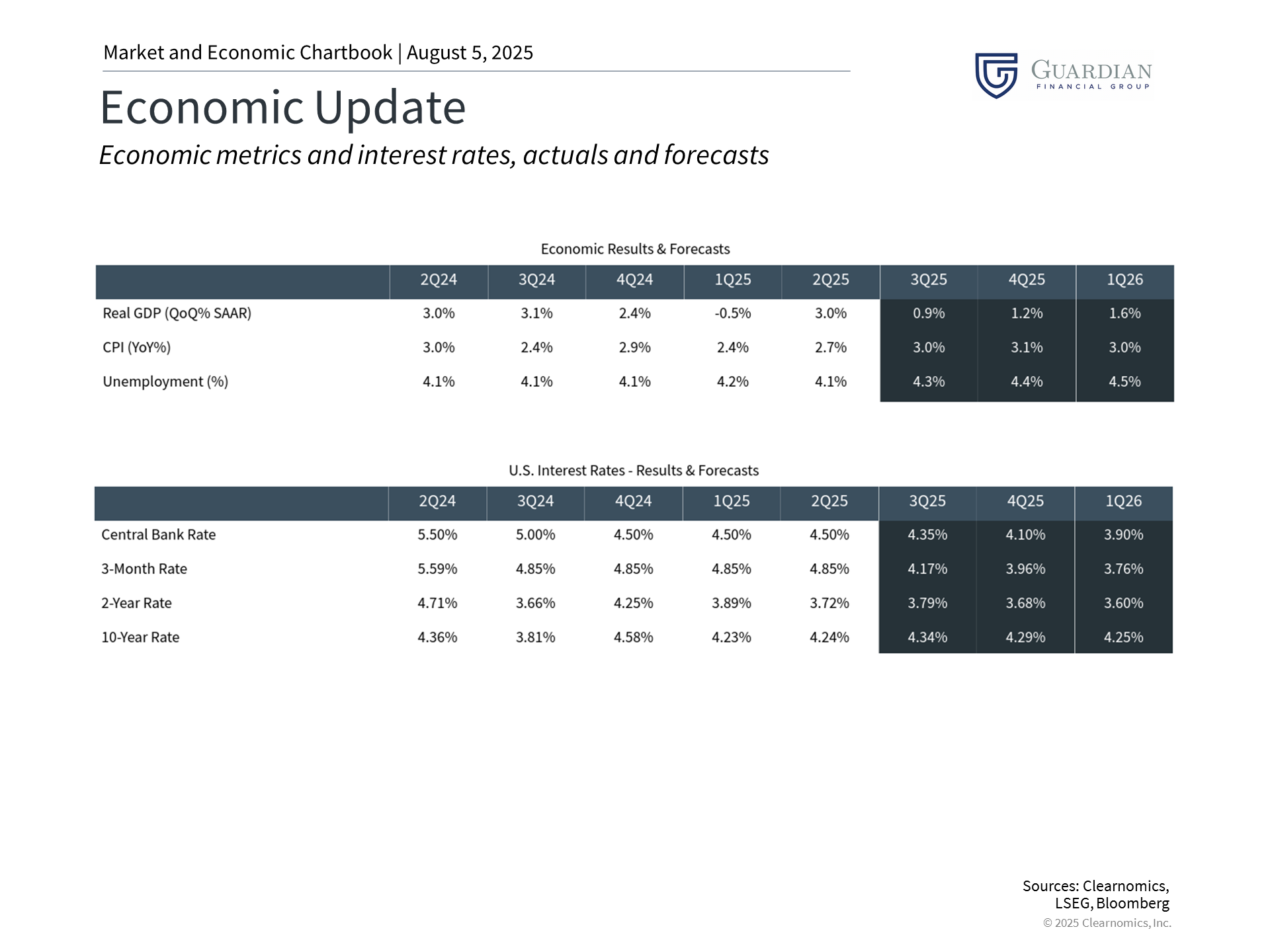

Much economic research focuses on determining which indicators matter most, their relative importance, and timing considerations. For instance, while recent employment statistics appear weaker than anticipated, alternative data suggests overall economic output continues expanding at robust rates. Second-quarter GDP acceleration reached 3.0%, significantly exceeding long-term averages and representing a clear reversal from first-quarter trends.

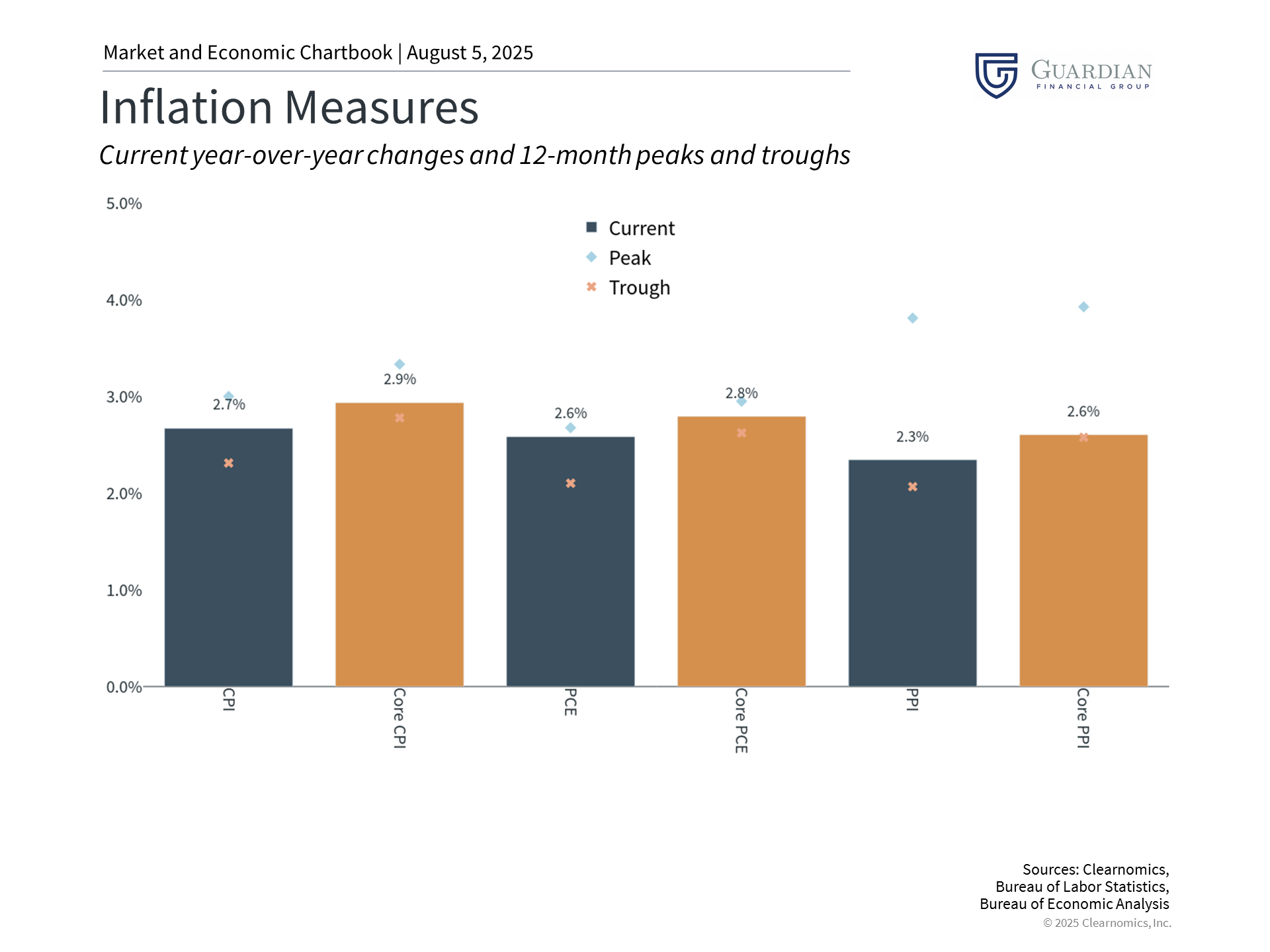

Tariff policies remain the primary uncertainty factor and represent one significant source of mixed economic perspectives. Inflation has not yet surged dramatically as some anticipated, though it persists stubbornly above the Federal Reserve's 2% objective.

Nevertheless, early indicators suggest tariffs may be influencing consumer pricing. The most recent Consumer Price Index data shows accelerating inflation for everyday goods even as service sector price pressures moderate. Furthermore, the latest Personal Consumption Expenditures figures demonstrate inflation acceleration to 2.6% in June compared to the previous year.

For market participants, economic indicators frequently point in divergent directions and occasionally appear contradictory. This sometimes reflects genuine economic uncertainty, while other instances stem from measurement difficulties. Regardless, long-term economic trajectory matters most for investment success, making diverse data source utilization essential for understanding the broader context.

The bottom line? Recent employment data has sparked questions about government statistics reliability. Market participants should comprehend both the applications and limitations of official data. Maintaining comprehensive perspectives based on varied information sources represents the optimal approach for long-term investment decision-making. | |||

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Guardian Financial Group are not affiliated. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.  |