Are Market Records a Sign to Adjust Your Investment Strategy?

| |||

Market Records: Maintaining Investment Discipline Through New HighsJune 30, 2025 | |||

Former President Dwight Eisenhower famously noted that "what is important is seldom urgent and what is urgent is seldom important." This wisdom perfectly illustrates the dilemma facing many investors today, as market developments and economic news often create a sense of urgency demanding immediate portfolio adjustments. Throughout this year, concerns about tariffs, global tensions, and economic uncertainty have dominated investor attention.

However, the most meaningful investment choices are rarely the urgent ones, but rather those made with patience and long-term vision. The fundamental drivers of wealth creation—maintaining discipline, consistent saving, regular portfolio contributions, and harnessing compound returns—demand strategic planning and commitment instead of reactive portfolio changes.

Following a difficult beginning to the year, equity markets have achieved fresh record territory, highlighting the importance of focusing on broader trends rather than daily market fluctuations. Both the S&P 500 and Nasdaq have exceeded their previous records, posting year-to-date gains of 5.1% and 5.0% respectively, while the Dow sits just 2.6% below its peak. This recovery reflects broad-based strength spanning various styles, sectors, and asset categories.

Although market obstacles remain on the horizon, this serves as a valuable reminder that adhering to long-term strategies has proven more beneficial than reacting to each news cycle. Given today's market conditions, how can investors maintain focus and stay committed to their investment approach?

Markets have achieved fresh record territory

Understanding that markets reaching new peaks is a normal occurrence is crucial for investors. Given that markets generally trend higher over extended periods, bull markets naturally spend considerable time at record levels. This doesn't suggest markets move in a straight upward trajectory, but it does indicate that investors who can look beyond short-term volatility are better positioned to capitalize on long-term market trends.

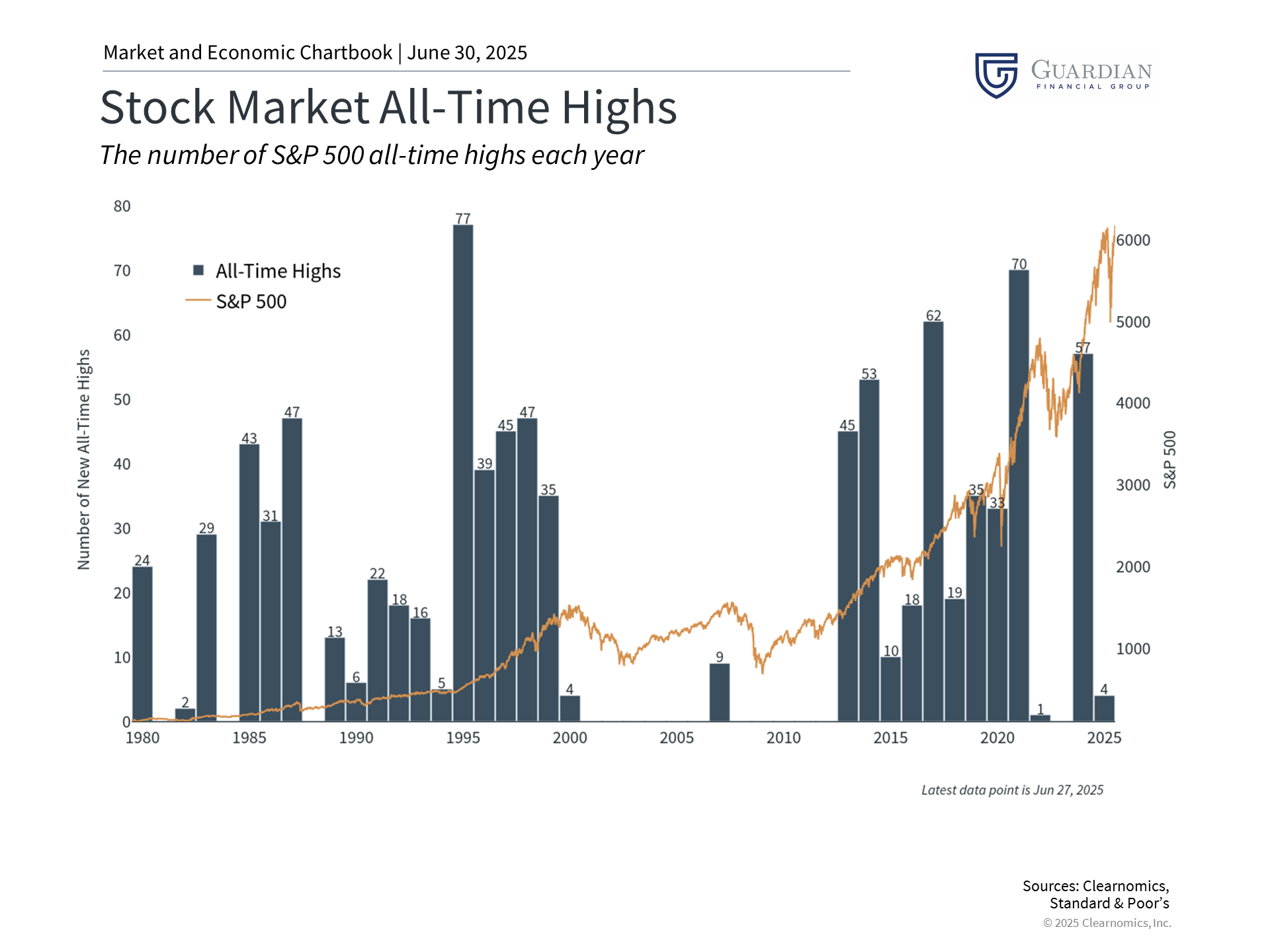

The chart illustrates how commonly new highs emerge throughout market cycles. Between 2013, when the S&P 500 recovered from the 2008 crisis, and 2024, markets averaged 37 new all-time highs annually based on daily closing values. This represents approximately 15% of all trading sessions—a figure that may surprise many investors. Certain years like 2017 and 2021 saw even higher frequencies. In 2024, markets recorded 57 closing records despite numerous investor concerns including recession worries and election uncertainty.

This phenomenon stems from market and economic cycles. During periods of economic expansion, equity markets typically advance in tandem. Since the mid-20th century, these cycles have extended in duration, with bull markets significantly outpacing bear markets in both length and performance—a trend that has rewarded investors who maintained their financial strategies. Therefore, new all-time highs don't necessarily signal cause for concern or indicate an imminent market reversal.

Following record market highs, some investors naturally wonder if they should "wait for a pullback." While periodic declines are unavoidable, attempting to time these movements often proves counterproductive. The opportunity cost of waiting for ideal entry points frequently exceeds the benefits of simply investing immediately.

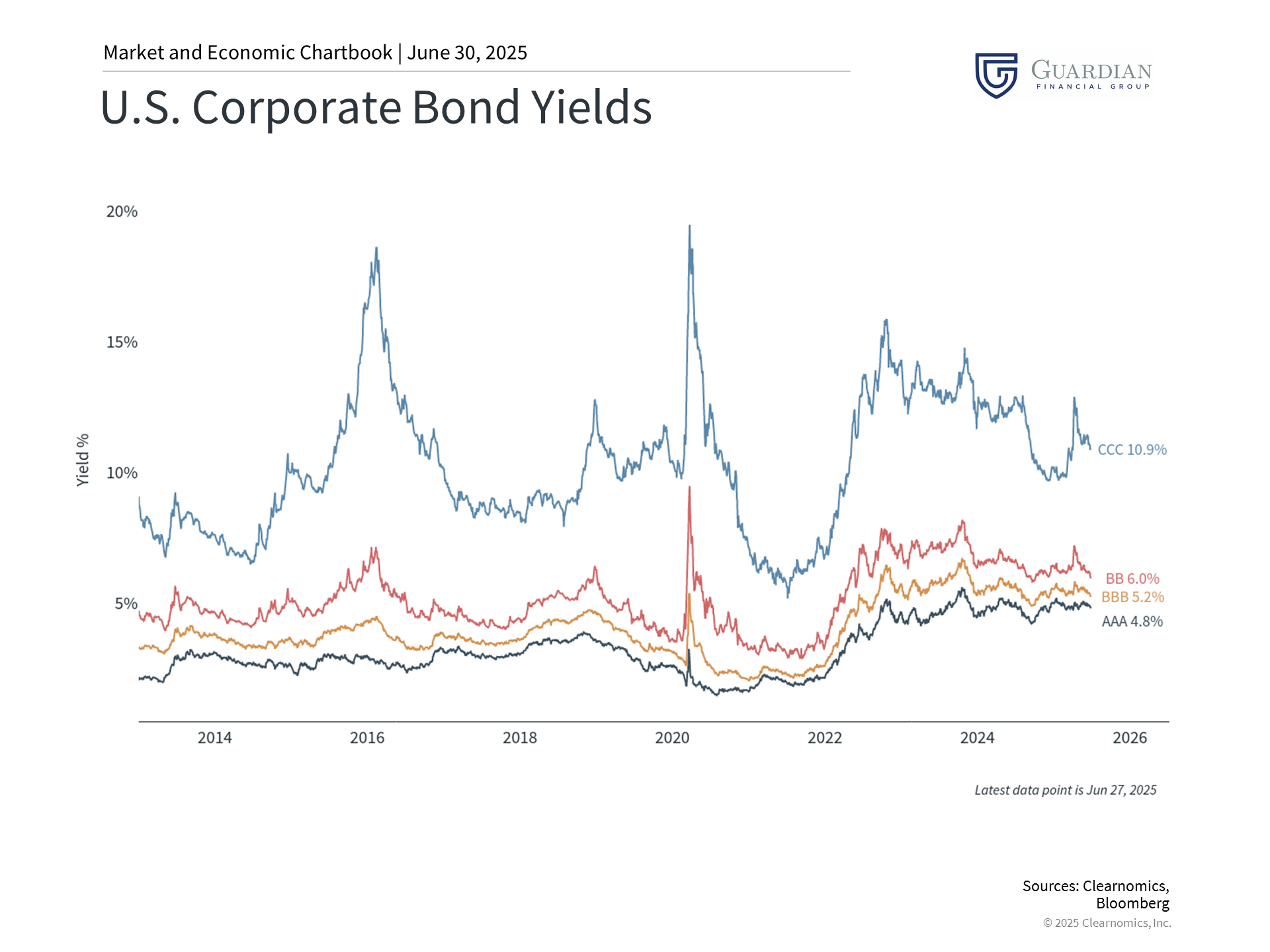

Corporate debt securities have strengthened following tariff developments

The upward momentum in equities has been matched by similar strength in fixed income markets, particularly corporate debt. Bonds are classified by credit quality, which measures the likelihood of investor repayment. Interest rates on these securities have declined recently, both in absolute terms and relative to Treasury yields. This phenomenon, known as credit spread "tightening," benefits investors as it indicates rising bond prices.

This occurs when economic stability and strong equity performance increase confidence in companies' ability to meet their debt obligations. This explains the frequent positive correlation between stock and credit markets, as they reflect similar underlying fundamentals. When investors drive stocks to record levels, corporate bond values also tend to benefit from optimism regarding economic conditions and corporate financial health.

This dynamic has supported the Bloomberg U.S. Aggregate Bond Index, a broad measure of U.S. fixed income securities, which has generated a 3.7% return year-to-date. The corporate bond segment has also delivered 3.7%, while high-yield securities have outperformed with 4.3% returns.

Narrowing credit spreads also indicate that the flight-to-safety behavior seen earlier this year has largely subsided for now. Tighter credit spreads can benefit the broader economy by enabling companies to access capital, fund expansion projects, and refinance existing obligations more affordably.

For investors, this reinforces that while equity markets capture most attention, various other asset classes have also contributed to portfolio performance this year. With the S&P 500 at historic highs, now represents an excellent opportunity to evaluate your asset allocation and confirm your financial strategy is prepared for all market cycle phases.

Portfolio diversification remains crucial amid strong returns

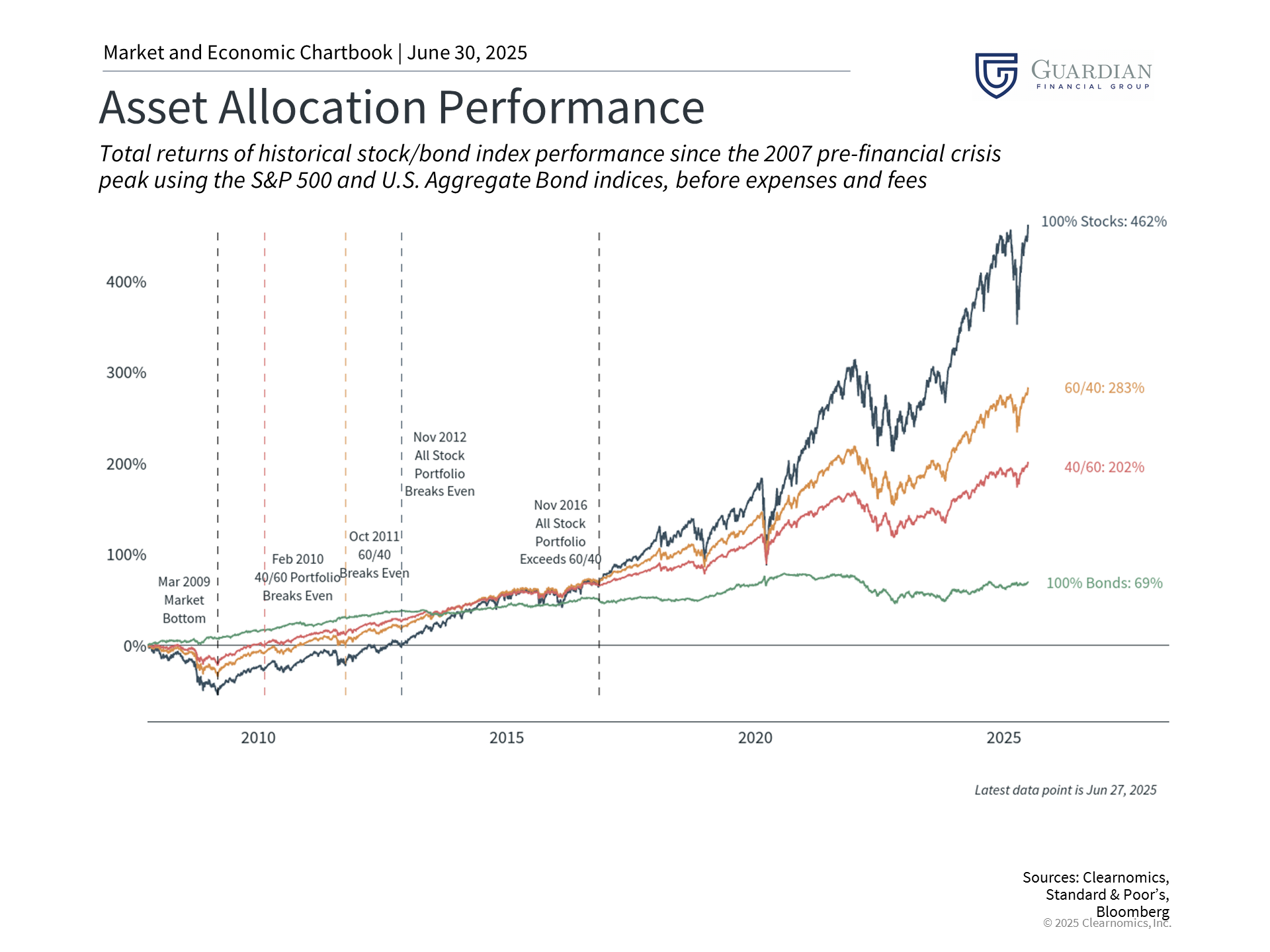

While strength across both equity and fixed income markets encourages investors, it also emphasizes the importance of maintaining disciplined portfolio construction. Effective portfolio building extends beyond investment returns alone. What truly matters is balancing risk and return potential, and understanding how each asset class contributes to this overall equilibrium. Proper implementation, with focus on long-term financial objectives, can ideally create a portfolio that serves investors across varying market environments.

Recent market history provides clear illustrations of how different asset classes perform under various conditions. The accompanying chart demonstrates how different portfolio allocations behave during both favorable and challenging periods.

Portfolios with heavy equity concentrations may outperform during market expansions but typically experience greater volatility during downturns. Incorporating bonds can smooth this journey, which likely helps ensure financial objectives are achieved. The optimal approach depends on individual risk tolerance and return requirements. Maintaining a comprehensive understanding of your goals and financial circumstances enables you to construct a portfolio capable of weathering the next bout of volatility when it inevitably arrives.

The bottom line? Despite the market's recovery, investors should maintain disciplined portfolio construction rather than pursuing recent winners. Historical evidence demonstrates that remaining invested throughout market cycles continues to be the optimal strategy for achieving long-term financial objectives. | |||

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Guardian Financial Group are not affiliated. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.  |