Is the 2.8% Social Security Raise Enough for Retirees?

| |||

Social Security Adjustments and Retirement Portfolios: Key ConsiderationsOctober 27, 2025 | |||

Ensuring adequate savings to sustain a lengthy retirement stands as the paramount objective for retirees and those nearing retirement. Inflation pressures experienced in recent years have diminished the buying power of cash reserves, making this goal more difficult to achieve. Essential expense categories that significantly impact retirees—such as healthcare, housing, and daily necessities—continue to reflect elevated price levels.

While equities and fixed income securities offer strong potential to address these concerns, some retirees exhibit caution toward risk, and others question whether their accumulated assets can adequately counter rising living costs. For those with extended investment horizons, comprehending inflation's impact on retirement income and implementing strategies to preserve purchasing power remains critically important. What key insights should current and future retirees understand about managing in this financial landscape?

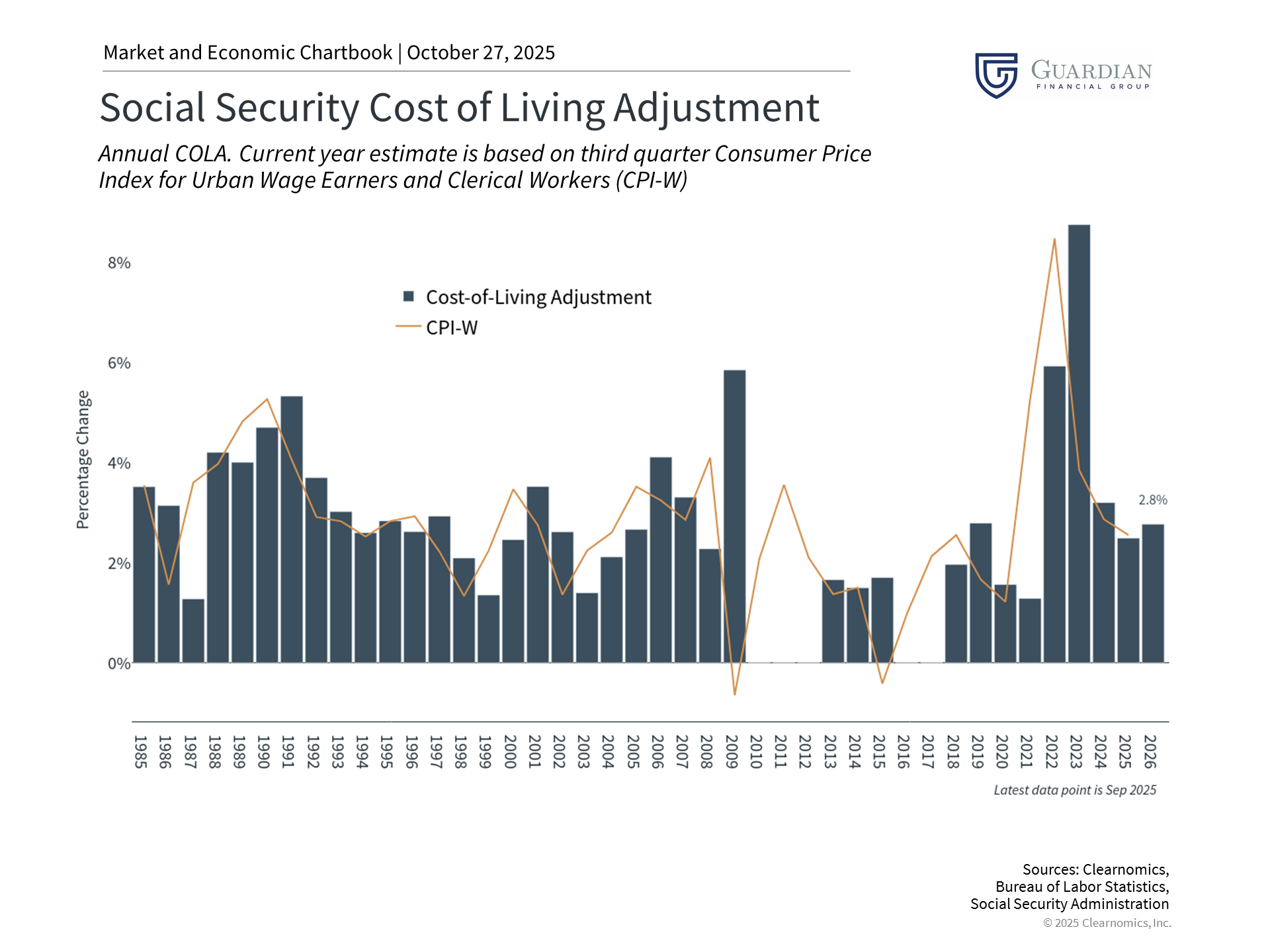

Cost-of-living increases from Social Security may not match actual inflation experienced

The Social Security Administration has announced a 2.8% cost-of-living adjustment (COLA) for 2026, acknowledging ongoing inflation. Although any increase provides assistance, the inflation measurements used by policymakers can diverge from the price changes individuals encounter in their daily lives. More specifically, this adjustment will increase the average monthly benefit to $2,064, representing just a $56 rise. This stands in stark contrast to the 8.7% adjustment implemented in 2023, which marked the highest increase since 1981.

The difficulty for retirees stems from the fact that while inflation may decelerate, prices themselves seldom decline. The COLA calculation relies on the CPI-W, a Consumer Price Index variant that monitors prices affecting working-class households. This metric fails to capture the reality that retirees typically encounter inflation rates distinct from those experienced by younger workers. Categories such as healthcare costs, housing expenditures, and other items that represent significant portions of retiree budgets have frequently increased more rapidly than the aggregate index indicates.

To illustrate, medical care services rose 3.9% annually, health insurance increased 4.2%, and home insurance jumped 7.5%. Food prices climbed 3.1% during this timeframe, though meat, poultry and fish surged 6.0%. Full service restaurant costs also grew 4.2% more expensive.

Compounding this challenge, Medicare Part B premiums are projected to increase $21.50 monthly in 2026, rising from $185 to $206.50 based on recent Medicare trustees' projections. Because this premium is generally deducted directly from Social Security payments, it would consume roughly 38% of the average $56 COLA increase, further diminishing retirees' actual purchasing power.

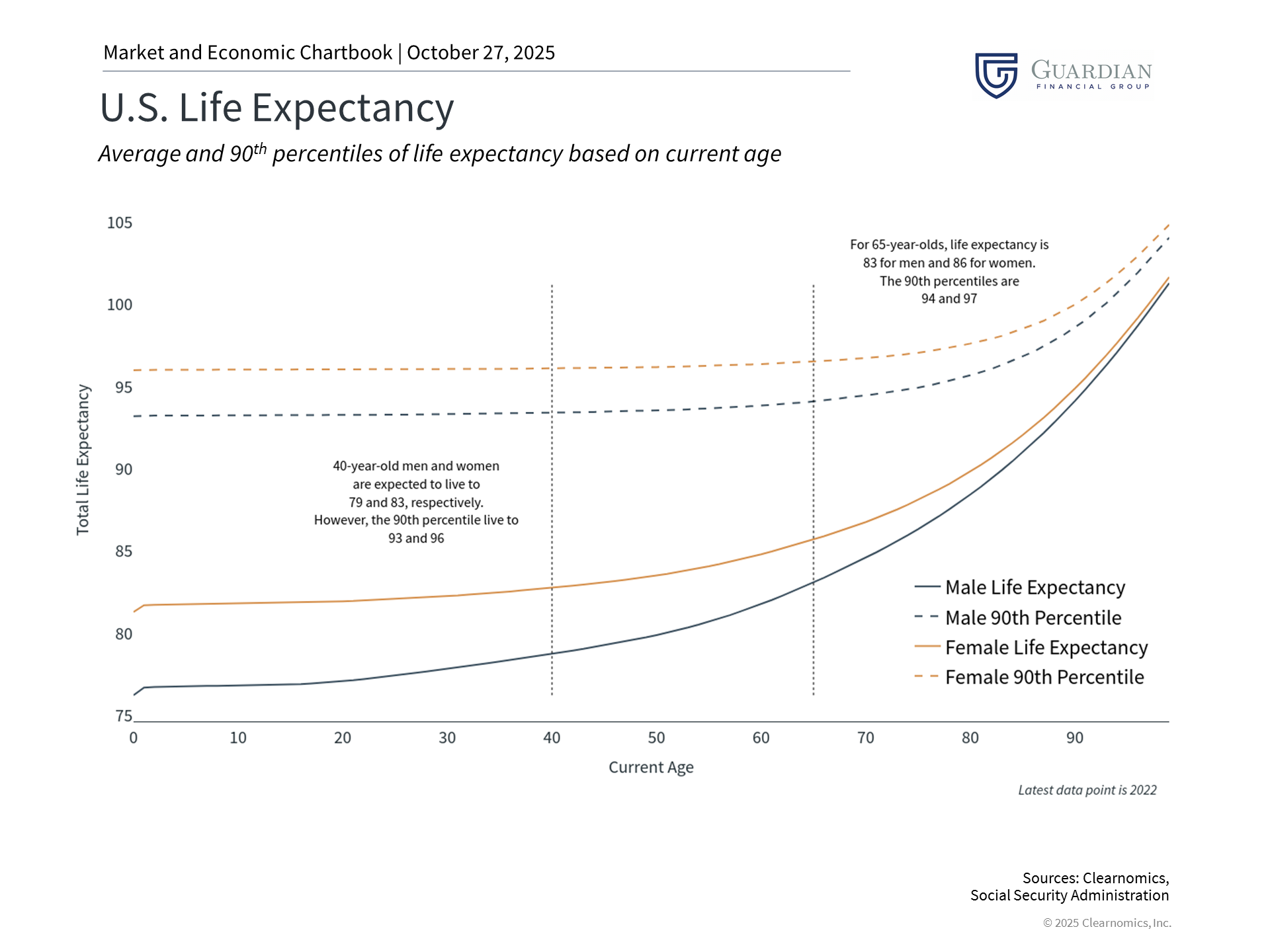

Extended lifespans amplify the need for portfolio appreciation

Similar to how investment returns compound through time, purchasing power erosion also compounds when a portfolio fails to outpace inflation. This consideration carries heightened significance today as retirees must prepare for potentially longer lifespans than earlier generations experienced. Consequently, life expectancy represents a crucial variable in comprehensive financial planning.

Based on current Social Security Administration statistics, 40-year-old males and females have average life expectancies of 79 and 83 years, respectively. For individuals reaching age 65, these expectancies extend to 83 and 86 years. These figures represent averages—individuals in the 90th percentile could survive to 94 and 97 years, respectively.

While the prospect of enjoying an extended, healthier retirement represents remarkable progress over the previous century, the distinction between a 20-year retirement and one lasting 30 years or more carries profound implications for portfolio design and withdrawal approaches. This phenomenon is sometimes termed "longevity risk," presenting an asymmetric challenge since depleting funds during retirement poses far greater problems than bequeathing assets to beneficiaries or charitable organizations.

Therefore, although many emphasize income-producing investments such as bonds for retirement planning, maintaining growth-focused assets like equities remains equally important. This reality also introduces financial complexities that make strategic planning increasingly valuable. Mastering portfolio structuring for multi-decade retirement horizons, while managing withdrawal percentages and adjusting to evolving market dynamics, demands expertise extending well beyond basic guidelines.

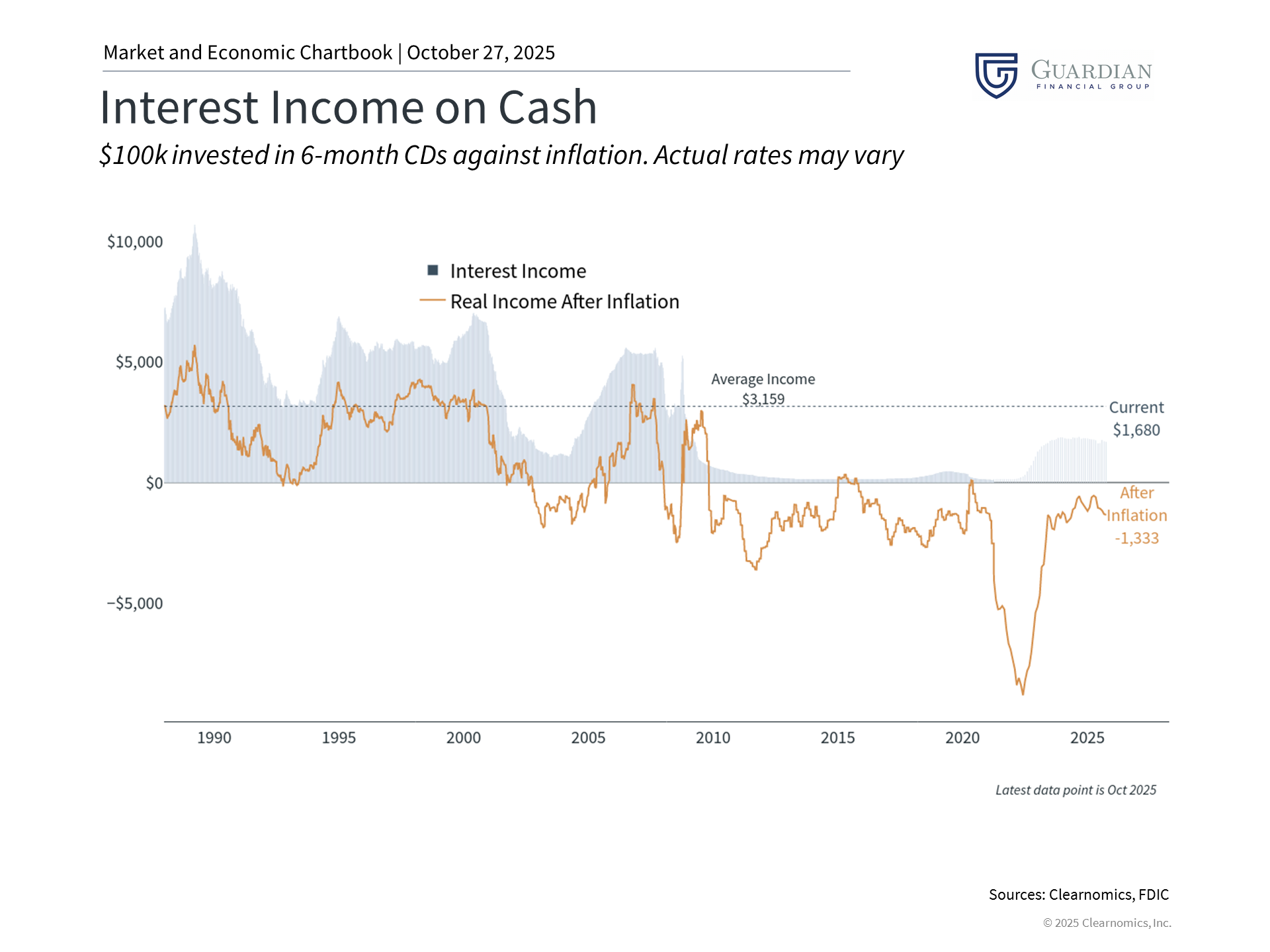

Declining short-term rates will reduce cash investment income

Recent Consumer Price Index information, which experienced delays due to the government shutdown, carries implications for Federal Reserve policy and broader interest rate trends. As inflation subsides and employment conditions soften, the Fed is anticipated to proceed with gradual policy rate reductions. While this transition benefits numerous economic sectors, it will probably diminish the interest income generated from cash holdings and money market accounts going forward.

For retirees who have relied upon interest income from cash reserves in recent years, this transition toward lower interest rates may create difficulties. Although maintaining some cash for immediate expenses and emergency funds remains prudent, excessive cash concentration means forfeiting the appreciation potential of equities and the compelling yields currently available across many bond categories.

The confluence of persistent yet moderating inflation and falling interest rates establishes a demanding environment for risk-averse investors. Cash experiences purchasing power erosion from inflation, while the interest it produces will diminish as the Fed pursues rate cuts. This underscores the heightened importance for retirees to maintain diversified portfolios incorporating growth-focused assets like equities, which have historically exceeded inflation over extended periods, combined with bonds offering income and stability.

The bottom line? Although Social Security COLA adjustments offer some protection against inflation, retirees find it challenging to depend solely on these increases. Given rising life expectancies and falling short-term interest rates, investors require portfolios capable of delivering both income generation and capital appreciation. | |||

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Guardian Financial Group are not affiliated. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.  |