Should Investors Worry About Federal Reserve Independence Under Political Pressure?

| |||

Federal Reserve Independence and Its Impact on InvestorsJuly 21, 2025 | |||

Current discussions between the White House and Federal Reserve have highlighted the importance of central bank independence. This spotlight emerges from the inherent tension between elected officials and the Fed, as each operates with distinct objectives and motivations.

Political leaders, including the President and Congress, typically favor reduced interest rates to stimulate economic expansion and support federal budget financing. Meanwhile, the Fed must navigate complex decisions regarding inflation control and financial stability, prioritizing long-term economic health over short-term political considerations.

While the Fed faces criticism and historical analysis reveals both achievements and shortcomings of various Fed chairs, central bank independence has remained a cornerstone of the financial system for generations. Current discourse focuses on legal questions about presidential authority to dismiss a Fed chair, procedural implications of such actions, and speculation about potential successors.

For investors, the critical consideration is whether monetary policy continues to serve economic stability and appropriateness. Regardless of administrative decisions, Jerome Powell's tenure as Fed Chair concludes by May 2026. What should investors anticipate regarding the Fed in the years ahead?

Central bank independence has transformed over decades

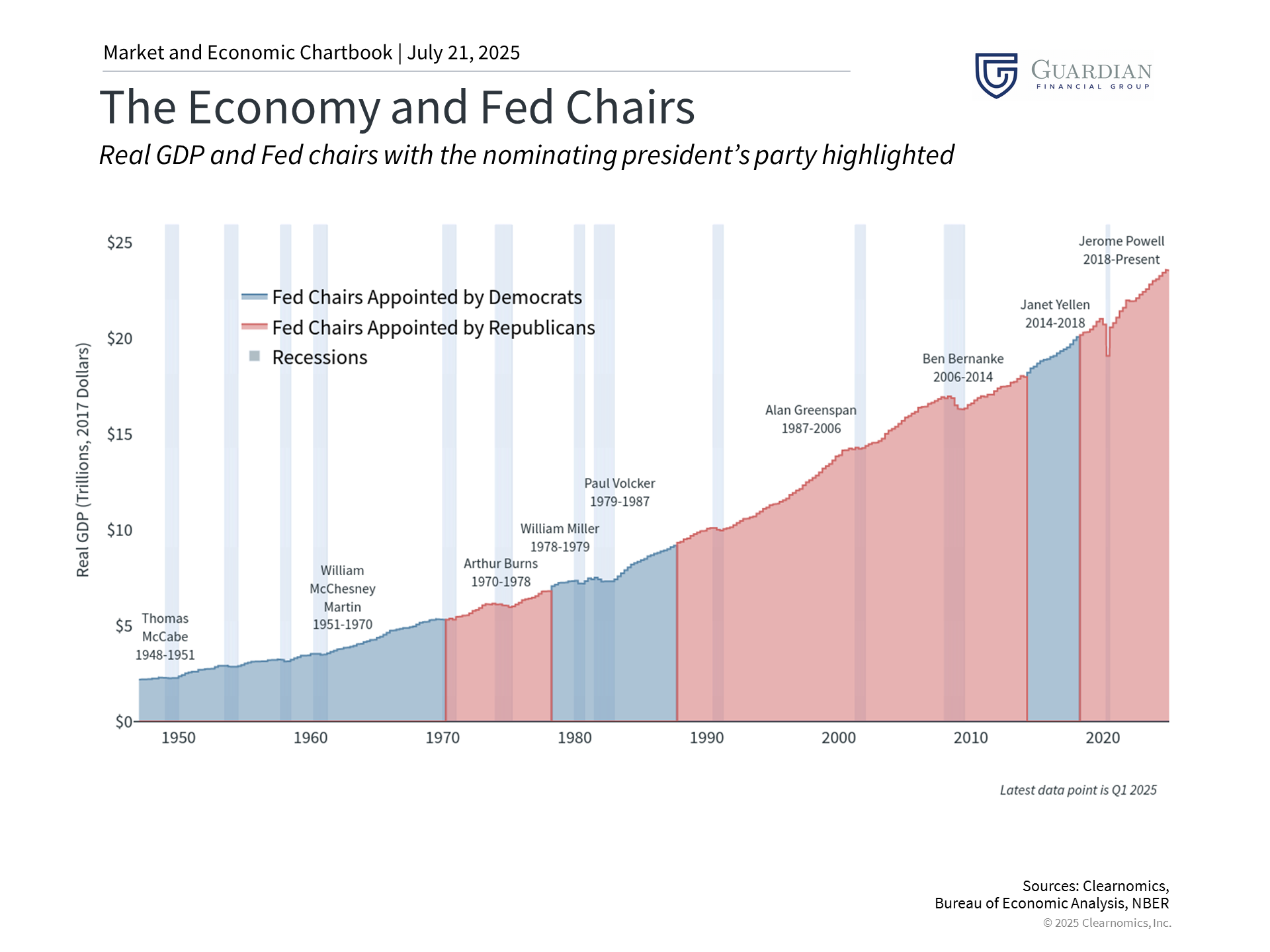

The chart illustrates nine Fed chairs appointed since 1948, with nearly all serving under presidents from both political parties and receiving re-nominations from different administrations. Jerome Powell exemplifies this pattern, initially nominated by President Trump in 2017 and confirmed for a second term under President Biden. The data demonstrates consistent economic growth under Fed chairs nominated by leaders from both parties.

Fed independence often seems assumed, making its historical context valuable to understand. As the nation's central bank, the Fed establishes monetary policy and supervises financial system stability. Independence enables the Fed to operate without political interference, basing decisions solely on economic and financial considerations.

This independence developed gradually over time. The Fed originated not from the Constitution but through the Federal Reserve Act of 1913, passed by Congress. The Fed's dual mandate has also evolved, commonly interpreted as maintaining low unemployment and targeting 2% inflation. Contemporary monetary policy reflects lessons learned from historical economic events, including recessions and inflationary periods.

After the Great Depression, the Banking Act of 1935 restructured the Fed, concentrating authority within the Board of Governors and removing the Treasury Secretary to minimize political influence. During World War II, the Fed temporarily sacrificed independence by maintaining low interest rates to support war financing. The 1951 Treasury-Fed Accord restored Fed independence by ending its obligation to support government bond prices.

Current inflation and policy conditions present challenges

The 1970s and early 1980s offer the most relevant historical comparison to today's environment. Before the 1972 election, President Nixon wanted accommodative monetary policy to support his campaign. Fed Chair Arthur Burns, Nixon's former economic advisor, complied by easing monetary policy, which economists believe fueled the subsequent decade's inflationary pressures.1

Paul Volcker's leadership in the early 1980s restored inflation control through recession-inducing measures. While most economists credit this approach with ending the "stagflation" period, it created political friction. Volcker's memoir describes Reagan administration pressure to avoid rate increases before elections.2

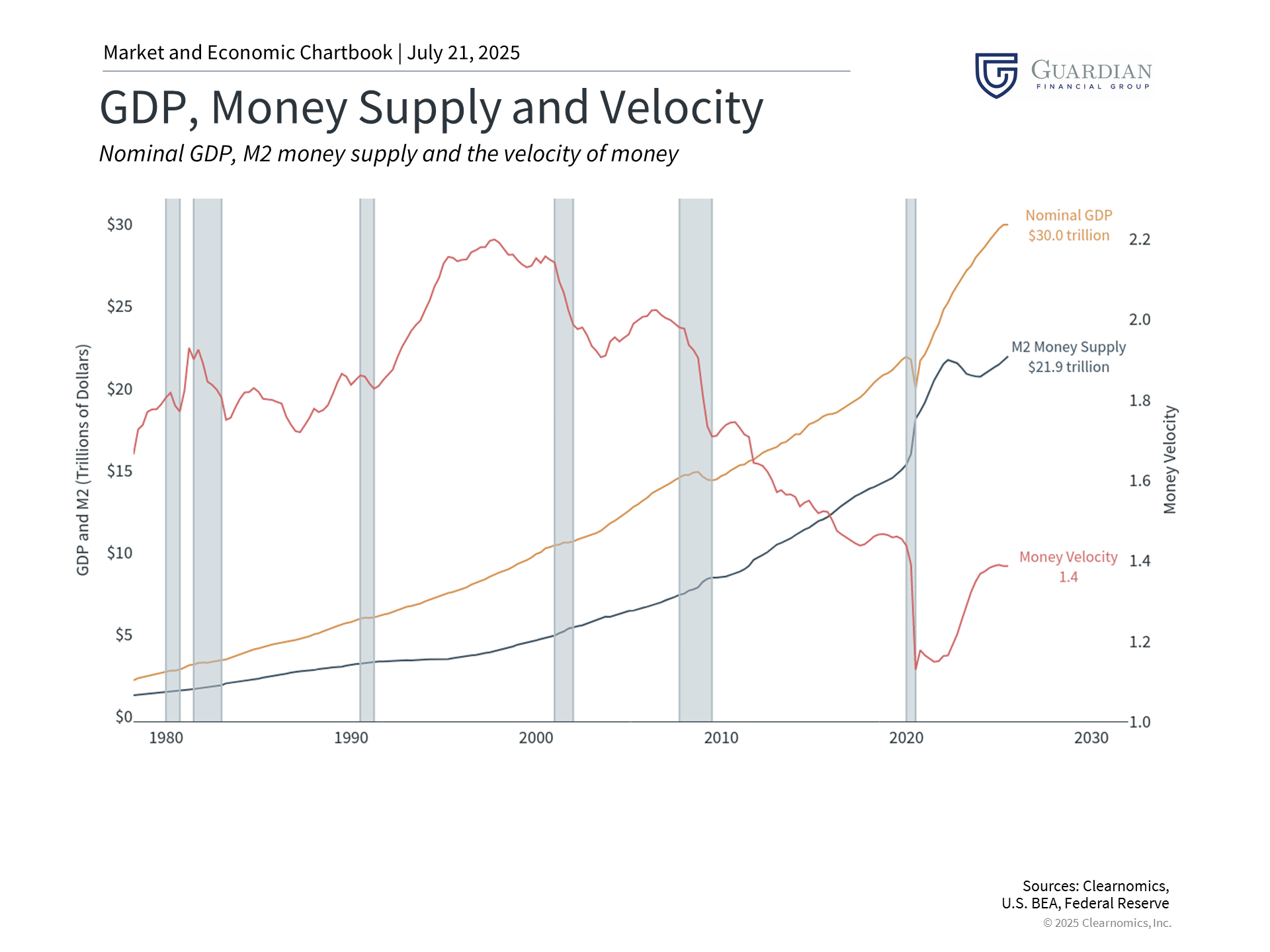

Today's economic landscape mirrors the 1970s, with tensions between maintaining higher rates to control inflation and reducing rates to stimulate growth. Although inflation has moved closer to the Fed's 2% target, headline CPI remains at 2.7% and core inflation at 2.9% according to recent data. The Fed maintains a cautious stance regarding tariffs' potential impact on consumer prices.

The money supply chart above illustrates this challenge. The Fed manages money supply, which typically grows steadily to support stable growth and inflation. During crises like 2020, money supply expansion supports the economy. However, recent years have seen flat money supply growth as policymakers combat inflation, potentially conflicting with some elected officials' preferences.

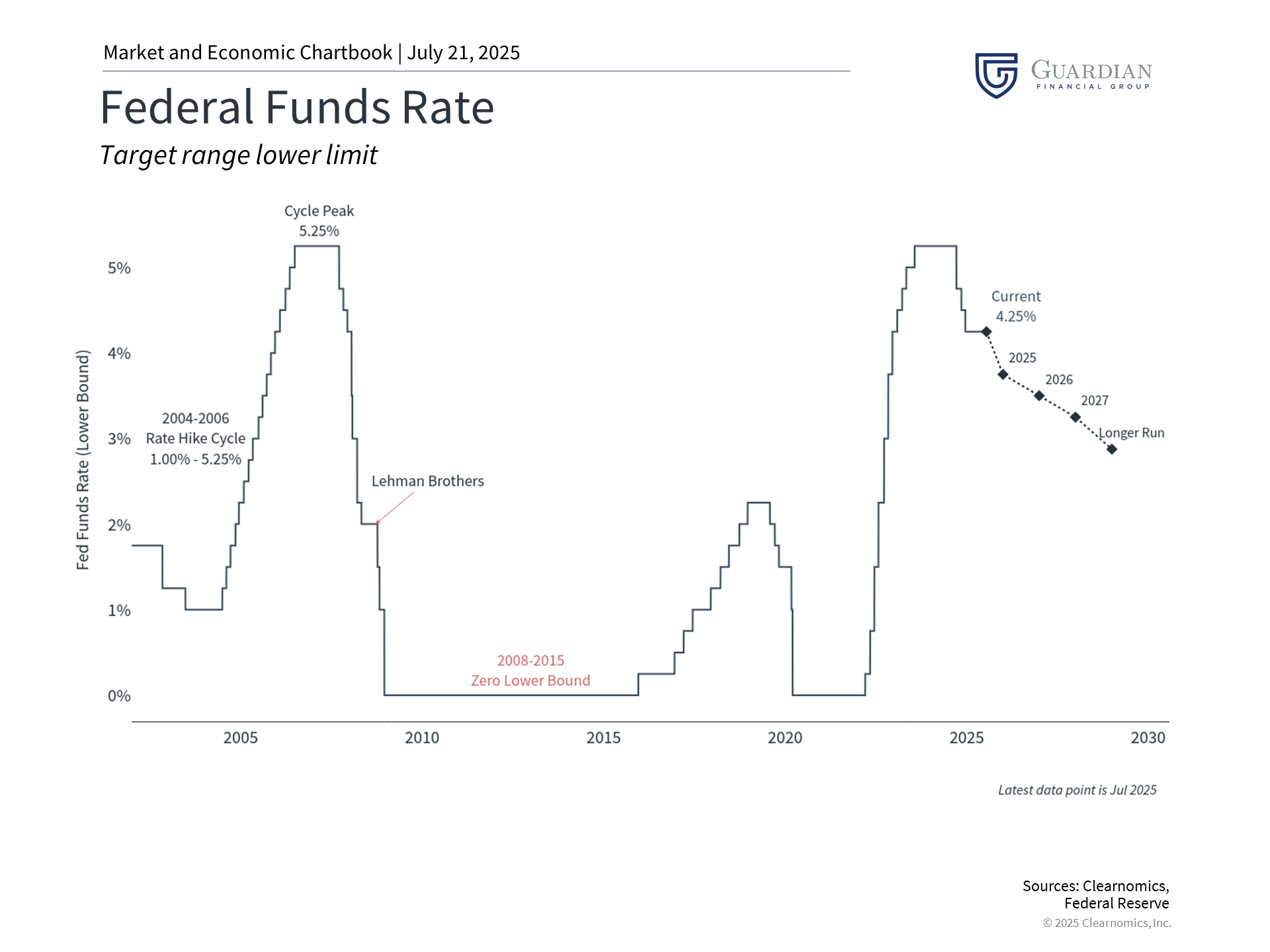

Further rate reductions remain anticipated

Beyond political considerations, the Fed is expected to implement additional rate cuts this year. Following several reductions in late 2024, the Fed has paused due to tariff-related uncertainty. Fed policy fundamentally supports long-term growth trends, requiring intervention when the economy risks overheating or needs stimulus during weakness.

This balancing act proves challenging under optimal conditions. Retrospectively, the Fed often faces criticism for being "behind the curve." Alan Greenspan, who served nearly 20 years as Fed Chair, failed to address the housing bubble emerging at his tenure's end. More recently, critics argue the Fed responded too slowly to clear inflation evidence in 2022.

Rather than debating past Fed actions, investors should focus on responding appropriately to current investment conditions with long-term strategies. History demonstrates that Fed leadership changes and policy shifts create uncertainty, yet markets have performed well despite these challenges.

The bottom line? Markets and the economy have thrived under various monetary policy and political environments. Maintaining a long-term strategy that can navigate uncertainty remains the optimal approach for achieving financial objectives.

1. https://www.aeaweb.org/articles?id=10.1257/jep.20.4.177 2. Volcker, P. A. (2018). Keeping At It: The Quest for Sound Money and Good Government | |||

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Guardian Financial Group are not affiliated. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.  |