How Will 2026 Tax Changes Affect Your Retirement Savings?

| |

Navigating Recent Tax Law Updates to Enhance Your Financial StrategyJanuary 22, 2026 | |

Former Senator Max Baucus aptly noted that "tax complexity itself is a kind of tax." This observation rings particularly true in 2026, as substantial shifts in tax policy introduce fresh opportunities for tax and financial planning. New limitations on retirement catch-up contributions and broadened deduction thresholds mean that comprehending these regulatory adjustments is crucial for making sound decisions in the year ahead.

These developments particularly impact investors over 50 with substantial earnings, making early-year planning essential. Rather than treating these policy modifications as isolated events, savvy investors can leverage them to enhance their approaches and bolster their long-range financial objectives.

New Roth mandates apply to catch-up contributions

Among the most notable developments for retirement savers in tax year 2026 concerns catch-up contributions. Historically, workers 50 and above have enjoyed the ability to exceed standard contribution limits, helping accelerate retirement savings. This provision benefits various circumstances, including late-start savers, those requiring additional funds for retirement, or individuals recovering from earlier financial difficulties.

Previously, investors could select between pre-tax and after-tax (Roth) alternatives. Beginning in 2026, high-income earners encounter a new constraint. Workers with Federal Insurance Contributions Act (FICA) wages reaching $150,000 or higher must now direct all catch-up contributions into Roth accounts. These funds are contributed post-tax but accumulate and can be accessed tax-free during retirement. The baseline catch-up limit has risen by $500 to $8,000 for individuals 50 and older, while the enhanced "super catch-up" for ages 60-63 stays at $11,250.

What makes this significant? High earners who formerly used pre-tax catch-up contributions to decrease their immediate tax obligations now face elevated taxable income in the current period. Consider a 55-year-old with $150,000 in annual earnings who would have previously made a $7,500 pre-tax catch-up contribution, thereby lowering their taxable income by that amount. Under current rules, this contribution must be made post-tax, raising their tax liability for the year.

Although Roth contributions provide advantages like tax-free appreciation and distributions in retirement, they deliver no current-year tax reduction. For those in peak earning periods who depend on catch-up contributions to control their present tax exposure, assessing how this modification impacts their tax planning approach is essential.

The SALT deduction ceiling has increased substantially

Another substantial modification expands possibilities for numerous taxpayers. The state and local tax (SALT) deduction has remained a focal point in tax policy for years, impacting millions who remit considerable state and local income, property, and sales taxes. This deduction enables taxpayers to lower their federal taxable income by their state and local tax payments, essentially avoiding multiple levels of government taxation on identical income.

The SALT deduction, limited to $10,000 following the Tax Cuts and Jobs Act of 2017, has been elevated to $40,000 for tax year 2025 and $40,400 for tax year 2026, with annual 1% increases through 2029 under the One Big Beautiful Bill Act (OBBBA). This adjustment impacts numerous Americans but proves especially meaningful for those in high-tax jurisdictions like California, New York, and New Jersey, where state and local taxes frequently surpass the former $10,000 threshold.

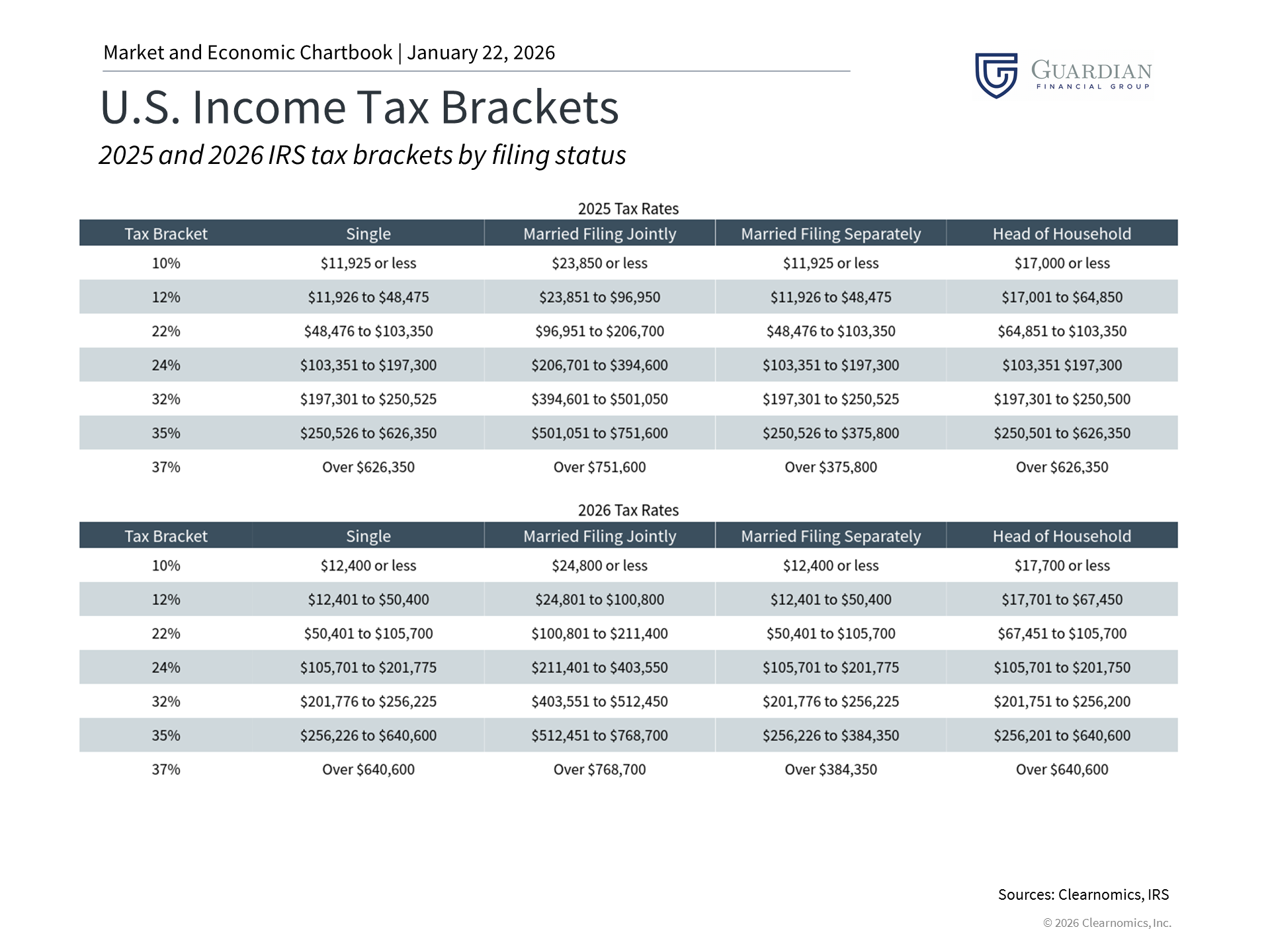

Notably, the elevated ceiling makes itemization more viable for many households who have utilized the standard deduction since 2017. Understanding its importance requires familiarity with tax calculations. Taxpayers choose between the standard deduction and itemizing deductions. For 2026, the standard deduction stands at $16,100 for individuals and $32,200 for married couples filing jointly. Itemized deductions encompass mortgage interest, charitable gifts, qualifying medical expenses, and state and local taxes.

When the SALT limitation was established at $10,000 in 2017, it significantly diminished itemization benefits for many households. Combined with the standard deduction's doubling then, the share of taxpayers itemizing dropped from roughly 30% pre-2017 to merely 10% in 2022 per the Tax Policy Center.1 With the SALT ceiling now at $40,400 in tax year 2026, substantially more households may discover itemizing reduces their tax burden.

As a basic illustration, consider a married California couple with $35,000 in state and local income tax, $8,000 in charitable donations, and $12,000 in mortgage interest. With the previous $10,000 SALT cap, their total itemized deductions would reach $30,000 ($10,000 SALT limit plus other deductions). Since this falls below the $32,200 standard deduction, they would not itemize. With 2026 regulations, they can deduct the complete $35,000 in state and local taxes, raising their itemized deductions to $55,000, which decreases their taxable income by an additional $22,800.

These modifications impact Social Security and broader financial planning

Tax planning complexity extends beyond grasping individual changes to understanding their collective impact on your complete financial situation. This complexity intensifies for retirees managing Social Security considerations.

For example, income thresholds determining Social Security benefit taxation remain unchanged for decades. Consequently, any modifications raising your Adjusted Gross Income (AGI), like the new Roth catch-up contribution requirements, may result in greater taxation of your Social Security benefits.

Additionally, a new "senior bonus" deduction exists for tax years 2025 through 2028 for individuals 65 and older. This provides an extra $6,000 deduction for single filers or $12,000 for married couples, even when itemizing. However, this benefit phases out for modified AGIs between $75,000 and $175,000 for individuals and between $150,000 and $250,000 for married joint filers. This introduces further complexity since decisions elevating your AGI might also diminish or eliminate this benefit.

The enhanced SALT deduction presents strategic possibilities, especially for those who previously claimed the standard deduction. If you now approach the itemization threshold, consider tactics like consolidating charitable donations into one year, prepaying property taxes where permitted, or coordinating other deductible expenses to optimize benefits. Naturally, specific strategies depend on individual circumstances. Remember that the elevated SALT cap is temporary, reverting to $10,000 in 2030, establishing a limited timeframe to capitalize on higher deductions.

The bottom line? The 2026 tax environment presents complexity with numerous interconnected elements affecting households uniquely. Taking a comprehensive view and planning strategically can improve prospects for financial success.

References 1. https://taxpolicycenter.org/briefing-book/what-are-itemized-deductions-and-who-claims-them | |

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Guardian Financial Group are not affiliated. Copyright (c) 2026 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.  |