Can Markets Keep Winning Despite Government Shutdown?

| |||

October Market Review: Navigating Volatility Amid Policy Shifts and Trade DevelopmentsNovember 4, 2025 | |||

Major equity indices posted solid gains throughout October, even as investors navigated uncertainty surrounding a federal government shutdown and fresh trade friction with China during the month's opening days. Multiple benchmark indices touched fresh record highs following a short-lived bout of market turbulence. Fixed income investments also delivered positive returns as yields moved lower, supported in part by the Federal Reserve's second straight interest rate reduction.

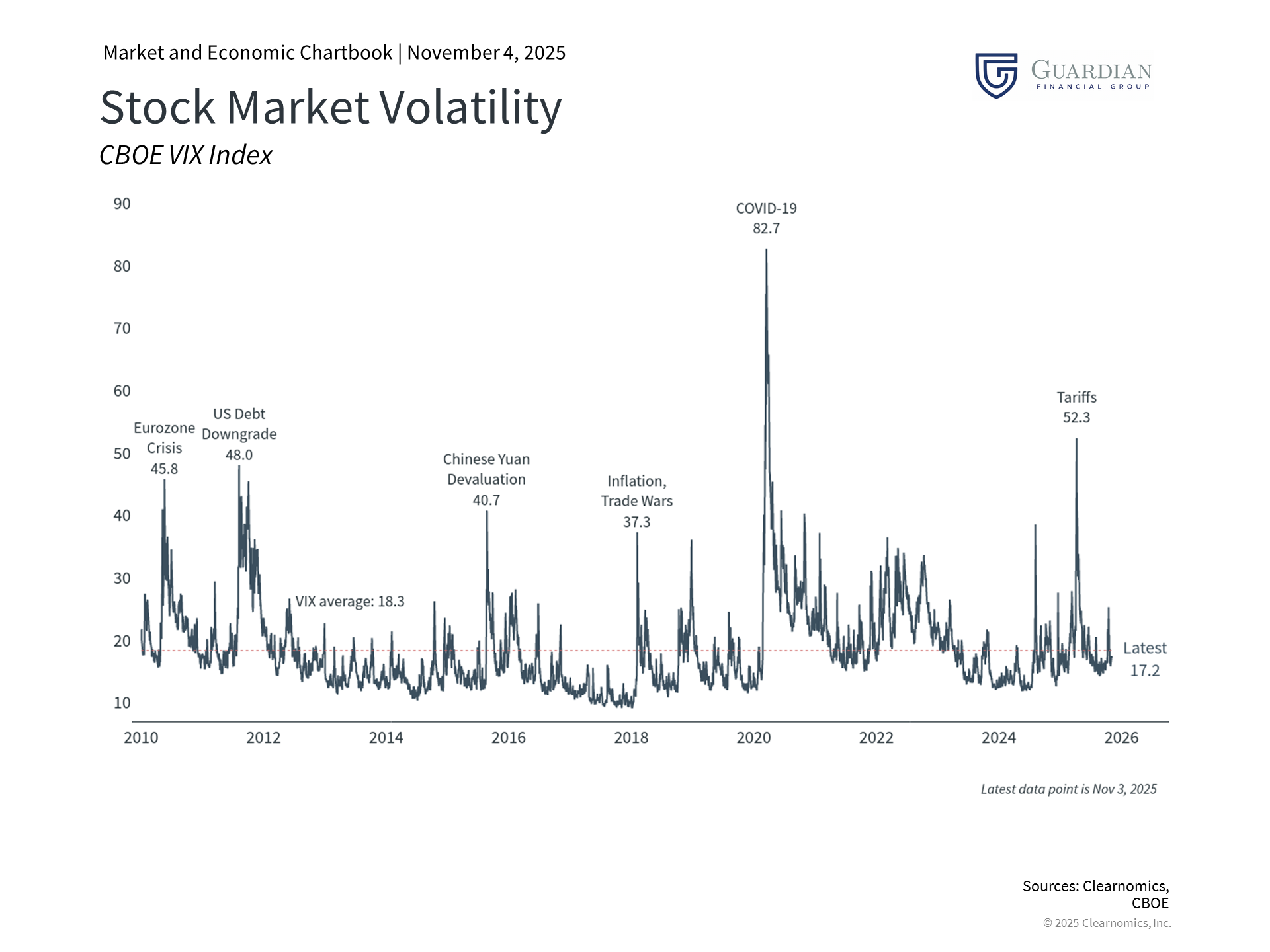

While returns were favorable, the month presented its share of obstacles. The continuing government shutdown dominated news coverage and sparked worries about economic contraction, while a temporary spike in tariff-related anxiety over rare earth materials triggered the steepest single-session drop since April. Markets bounced back swiftly, however, highlighting why investors shouldn't react impulsively to short-term news. These developments also drove gold prices to unprecedented levels before retreating as October drew to a close.

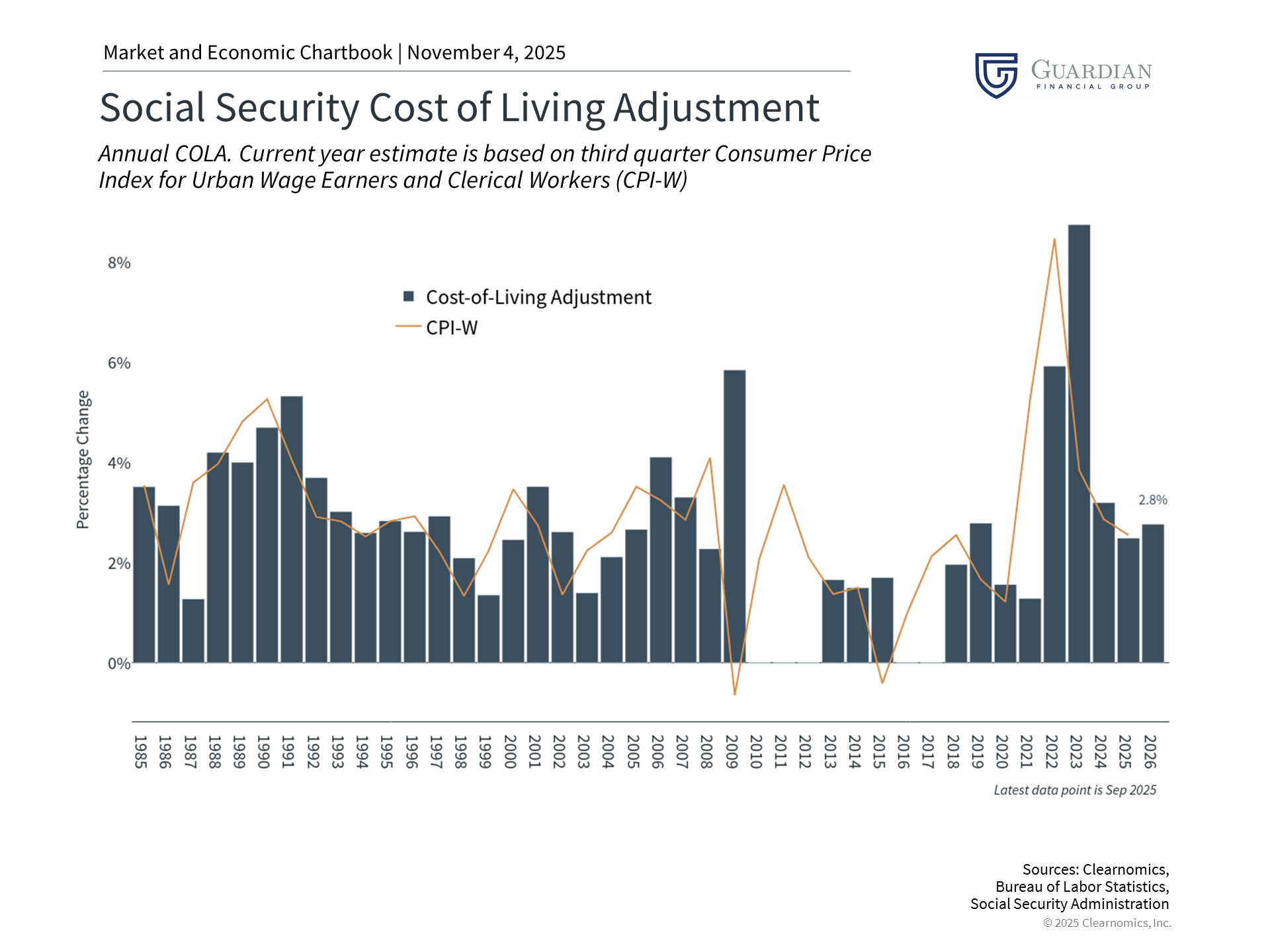

Additionally, the Social Security Administration revealed a 2.8% cost-of-living adjustment for 2026, a relatively small bump compared to adjustments in prior years that might fall short of covering the escalating costs many retired individuals encounter. When combined with diminishing yields on cash positions, this development emphasizes why portfolios need to deliver both current income and capital appreciation.

Through all these fluctuations, October's results demonstrate that staying committed to a portfolio designed around long-term objectives continues to be the optimal strategy for managing uncertain conditions.

Key Market and Economic Drivers

Government operations remained disrupted but markets stayed resilient

The month opened with the federal government shutdown already underway, an impasse now nearing historic length. These situations arise when lawmakers cannot reach consensus on appropriations legislation or continuing resolutions to extend funding. Numerous departments, including those responsible for releasing important economic statistics, have functioned with skeleton crews since the shutdown began.

Though the shutdown causes genuine hardship for numerous government employees and their households, maintaining context regarding portfolio implications remains essential. Historical evidence shows that government shutdowns typically haven't produced enduring impacts on capital markets, as government expenditures are generally deferred rather than eliminated altogether. The prior record shutdown extended 35 days from 2018 into 2019, yet the S&P 500 subsequently delivered a 31.5% gain in 2019. While past performance doesn't guarantee future results, this pattern suggests markets frequently move beyond these disruptions.

Concerns have also emerged regarding workforce reductions through reductions in force. Within the context of the overall economy, federal government positions account for merely 1.8% of total employment, and recent reduction-in-force announcements represent just 0.002% of aggregate U.S. employment. Although the shutdown generates authentic challenges for impacted workers and disrupts government operations, its broader economic footprint stays contained.

Tariff concerns sparked temporary market weakness

Markets also witnessed their most pronounced single-day retreat since April, triggered by heightening friction between the U.S. and China concerning rare earth materials, along with potential 100% tariffs on Chinese imports. Rare earth elements represent among China's most significant advantages in trade negotiations. China maintains roughly 70% of worldwide rare earth extraction and close to 90% of refining operations, generating substantial supply chain dependencies.

Following the sharp decline, markets rebounded rapidly after the White House adopted more measured rhetoric. Presidents Trump and Xi subsequently convened toward month-end, producing a de-escalation and a 10% reduction in tariffs applied to China.

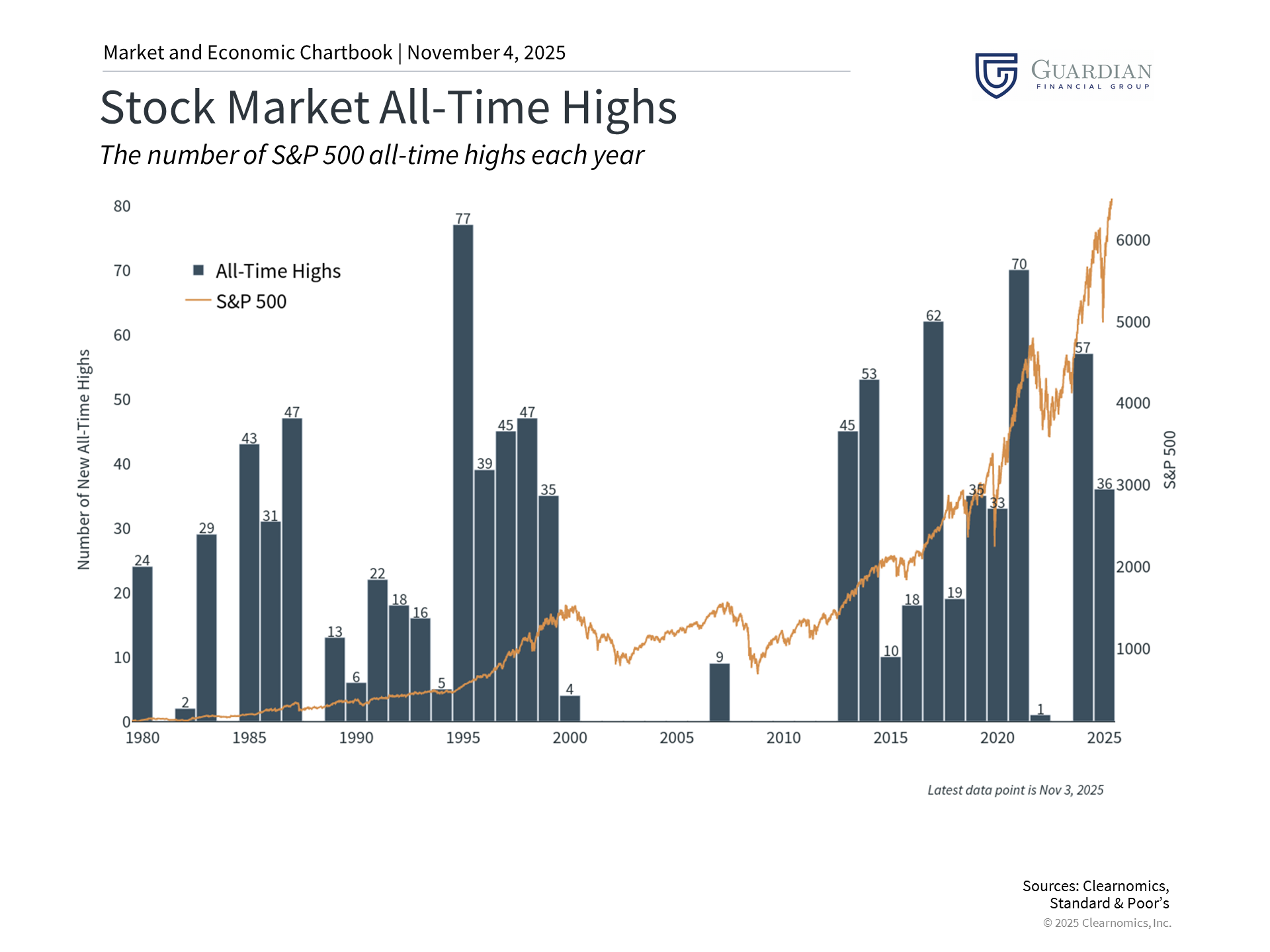

This sequence has recurred multiple times throughout the year, with trade-related worries triggering temporary declines before markets regain their footing. More specifically, the S&P 500 has climbed 37% from its April trough and established 36 fresh all-time peaks this year through October. Naturally, markets never advance in linear fashion, so these episodes serve as reminders that brief intervals of market turbulence represent normal, anticipated occurrences.

The Fed maintains its accommodative policy direction

During its October gathering, the Federal Reserve reduced interest rates by 0.25% to a target range of 3.75% to 4.00%, representing its second consecutive rate reduction. This action demonstrates the Fed's commitment to sustaining economic expansion while balancing inflation pressures and softening employment conditions. The Fed's statement acknowledged that "uncertainty about the economic outlook remains elevated" and that "downside risks to employment rose in recent months."

Market pricing indicates another rate reduction appears probable by January, with potentially one or two further cuts during 2026. Beyond short-term rates, the Fed also disclosed it would conclude balance sheet reduction in December. This decision means they would resume purchasing bonds, effectively preserving accommodative monetary conditions. Throughout the preceding three years, the Fed tightened policy through a $2.2 trillion balance sheet contraction, so halting this process delivers additional economic accommodation. For market participants, declining rates and supportive monetary policy have traditionally generated opportunities across multiple asset categories.

Retired individuals confront headwinds from limited COLA increases and declining yields

The Social Security Administration disclosed a 2.8% cost-of-living adjustment (COLA) for 2026, indicating persistent yet moderating inflation. For typical Social Security recipients, monthly payments will reach approximately $2,064, representing an increase of merely $56. Though any enhancement provides some relief, this limited adjustment appears modest when compared to the 8.7% boost in 2023, which marked the largest since 1981.

The difficulty for retired individuals stems from the COLA calculation methodology, which relies on an index that might not capture the actual inflation they encounter. Healthcare expenditures, shelter costs, and other categories that comprise significant portions of retiree spending have frequently escalated more rapidly than the broader index. As examples, medical care services advanced 3.9% over the past year, health insurance expanded 4.2%, and home insurance surged 7.5%. Food prices increased 3.1%, though meat, poultry, and fish climbed 6.0%.

Given that life expectancies keep extending—numerous retirees will reach their 90s—preparing for retirement periods spanning multiple decades demands portfolios capable of delivering both income and appreciation. Recognizing how to construct portfolios for these prolonged timeframes, while managing distribution strategies and adjusting to evolving market environments, highlights the importance of thorough financial planning.

The bottom line? Markets delivered strong October performance despite government shutdowns, trade friction, and various uncertainties. Staying committed to a well-constructed portfolio designed to weather these challenges continues to represent the most effective approach as year-end approaches. | |||

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Guardian Financial Group are not affiliated. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.  |